– Can companies in industries other than automotive and electronics benefit from reshoring to Mexico?

Unlocking the Power of Mexico in the U.S. Reshoring Mission

In recent years, there has been a growing trend of reshoring operations from overseas back to the United States. This trend has been driven by various factors, including rising labor costs in countries like China, increasing transportation costs, and a desire to reduce supply chain risks. However, while reshoring to the U.S. has many benefits, companies looking to bring their manufacturing operations back closer to home can also consider Mexico as a strategic location.

Why Mexico?

Mexico has become an attractive option for companies looking to reshore for several reasons:

Cost-Competitive Labor: Mexico offers competitive labor costs compared to the U.S., making it an attractive option for companies looking to reduce manufacturing costs.

Proximity to the U.S.: Mexico’s close proximity to the U.S. is a major advantage for companies looking to reshore operations. This proximity makes it easier to oversee operations, reduce transportation costs, and maintain shorter supply chains.

Skilled Workforce: Mexico has a well-trained and skilled labor force, particularly in industries such as automotive, aerospace, electronics, and medical devices.

Trade Agreements: Mexico has strong trade agreements with the U.S. and other countries, making it easier for companies to export goods and access global markets.

Benefits of Reshoring to Mexico

When companies decide to reshore operations to Mexico, they can benefit in several ways:

Cost Savings: Companies can achieve significant cost savings by leveraging Mexico’s lower labor costs and competitive manufacturing environment.

Faster Time to Market: Proximity to the U.S. allows companies to reduce lead times and respond more quickly to market demands.

Improved Quality Control: Being closer to manufacturing facilities in Mexico allows for better oversight and control over production processes, leading to improved quality control.

Reduced Risks: Mexico’s stable political environment, strong intellectual property protection, and reliable infrastructure help reduce risks associated with manufacturing operations.

Case Studies

Several companies have successfully reshored operations to Mexico and have reaped the benefits of doing so:

Company A, a medical device manufacturer, reshored its production from China to Mexico. By doing so, they were able to reduce lead times, improve quality control, and lower costs by leveraging Mexico’s skilled labor force.

Company B, an automotive supplier, moved its manufacturing operations from Asia to Mexico. This move allowed them to benefit from reduced transportation costs, faster time to market, and improved supply chain flexibility.

Practical Tips for Reshoring to Mexico

If your company is considering reshoring operations to Mexico, here are some practical tips to keep in mind:

Conduct Due Diligence: Research potential locations in Mexico, assess labor costs, infrastructure, and workforce skills to find the best fit for your operations.

Collaborate with Local Partners: Work with trusted partners in Mexico who can help navigate the local business environment, provide support with logistics, and ensure compliance with regulations.

Invest in Training: Invest in training programs to upskill the local workforce and ensure they meet your quality and productivity standards.

Monitor Performance: Establish key performance indicators to monitor the success of your reshoring efforts and make adjustments as needed.

Mexico offers a compelling option for companies looking to reshore operations and unlock the power of manufacturing closer to home. By leveraging Mexico’s cost-competitive labor, skilled workforce, and strategic location, companies can realize cost savings, improve quality control, and reduce risks associated with offshore manufacturing. With careful planning, collaboration with local partners, and investment in training, companies can successfully reshore operations to Mexico and benefit from a more competitive and resilient supply chain.

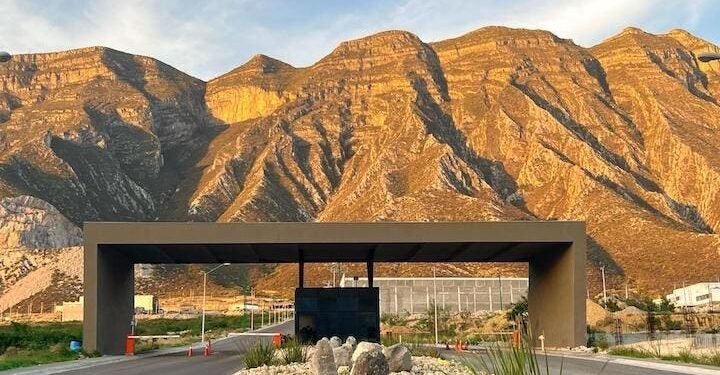

Manufacturing Center in Monterrey, Mexico

With the escalating global tensions and the ongoing challenges faced by the supply chain industry, exploring alternative manufacturing regions has become imperative. A deep dive into four major global manufacturing hubs, namely Mexico, India, the U.S., and China, unveils the critical role they play in the broader supply chain diversification strategy.

Managing supply chains in the current volatile environment is no easy task, especially with the relentless push to optimize resources amidst the chaos of global disruptions. The prevailing market conditions have been likened to a smaller-scale version of the COVID crisis, emphasizing the severity and frequency of supply chain disturbances.

The strained relationships between major economic players such as the U.S., EU, and China, coupled with ongoing shipping challenges and pivotal elections in key regions like the U.S., India, Mexico, and the EU, have added an extra layer of complexity for decision-makers. An increasing number of supply chain and manufacturing leaders are now grappling with the potential impacts of these dynamics on long-term business strategies.

Delving into the global landscape for diversified supply chain options, the focus shifts to China, India, the U.S., and Mexico. In this particular investigation into Mexico as a viable option for U.S. businesses seeking enhanced North American production alternatives, a wealth of insights emerge.

The Role of Mexico in Regionalized Strategies

As the quest for increased supply chain resilience gains momentum, many industry leaders are turning towards regional diversification as a strategic safeguard against supply chain risks. The concept of nearshoring, with Mexico emerging as a prominent choice, is gaining traction among decision-makers.

Recent data from the 2024 State of Manufacturing Report underscores the growing interest in nearshoring to North America and reshoring to the U.S. as key strategies to mitigate supply chain vulnerabilities. Mexico and Latin America have notably gained prominence in regionalization plans, surpassing regions like Northeast Asia, Eastern Europe, and Southeast Asia in preference among industry leaders.

This preference is well-founded as Mexico boasts the status of being the world’s 15th largest economy. With foreign direct investment projected to reach $30 billion in the current year and contributing 2% to the GDP, Mexico holds a pivotal position in the global value chain. The robust infrastructure and solid manufacturing foundation in Mexico paint a promising picture of sustained economic growth in the region.

Leading multinational corporations such as Tesla, Nissan, Honeywell, and AT&T have already capitalized on the advantages of nearshoring to Mexico. This strategic shift offers companies enhanced resilience, particularly in scenarios where fast, on-demand, or just-in-time manufacturing services are crucial, without compromising on quality.

Evolution of Mexico as a Nearshoring Destination

Trade agreements driving nearshoring initiatives

The evolution of Mexico as a prominent nearshoring destination stems from the series of impactful trade agreements between Canada, Mexico, and the U.S. These agreements have facilitated seamless exchanges of goods and services across borders, propelling Mexico onto the global manufacturing stage.

Formative Years (1960s-1980s)

The inception of the maquiladora program in 1965 marked a significant milestone in shaping Mexico’s position in global supply chains. This program streamlined the process for foreign companies to establish manufacturing facilities in Mexico, allowing for duty-free import of raw materials and subsequent export of finished products to their respective home countries. Initially focusing on labor-intensive industries like textiles and electronics along the U.S.-Mexico border, these factories have witnessed significant expansion over the decades.

NAFTA Era (1994-2018)

The era of the North American Free Trade Agreement (NAFTA) from 1994 to 2018 revolutionized the concept of free trade zones, marking a milestone in the trade relations between the U.S., Canada, and Mexico. With NAFTA eliminating most tariffs between the three nations, Mexico emerged as an attractive manufacturing destination due to its competitive labor costs and close proximity to the U.S. The period saw a surge in investments across various sectors such as automotive, electronics, and aerospace, with industry giants like General Motors, Ford, and Boeing expanding their operations in Mexico.

Post-NAFTA and USMCA Era (2018-Present)

The United States-Mexico-Canada Agreement (USMCA), replacing NAFTA in 2020, introduced new rules aimed at modernizing trade relationships among the three nations. These changes include stringent rules of origin for automotive products, enhanced labor standards, and improved IP protections, all of which have bolstered Mexico’s manufacturing sector. The USMCA has sparked over $68 billion in new economic activity and witnessed a substantial surge in total trade volumes between the U.S., Mexico, and Canada, underscoring its efficacy in boosting trade amidst global economic challenges.

The USMCA has not only fostered economic growth but has also been pivotal in job creation, supporting millions of jobs across the three countries. With a focus on labor and environmental standards, the agreement has ushered in improved working conditions and environmental outcomes in the region, particularly within the high-wage automotive sector.

The digital trade and intellectual property provisions of the USMCA have further solidified its impact, offering robust protections for digital products and services and stringent IP enforcement mechanisms.

Key Industries Driving Mexico’s Manufacturing Landscape

A Fictiv manufacturing partner in Monterrey, Mexico

Aside from automotive manufacturing, Mexico boasts thriving sectors such as aviation, aerospace, medical devices, and custom mechanical parts.

The automotive industry stands out as a global hub with major players like General Motors and Ford operating manufacturing plants in the country. Forecasted to become the world’s fifth-largest vehicle producer by 2025, Mexico is a substantial exporter of U.S. auto parts, underlining its strategic significance in the automotive domain.

Aviation and aerospace have also emerged as key focus areas for Mexico, with the industry ranking as the seventh-largest U.S. export market. Mexico’s strategic location and trade agreements have positioned it as a preferred destination for aerospace and aviation investments.

The production of custom mechanical parts has seen a significant uptick in Mexico, with industries like automotive, aerospace, and industrial machinery leveraging the country’s manufacturing prowess and skilled workforce to efficiently produce specialized components.

Medical devices represent another booming sector in Mexico, with the country being the largest manufacturer of medical devices in North America. This industry, encompassing a wide range of products from catheters to robotic surgery tools, primarily exports to the U.S. and Canada.

The steady influx of companies relocating their manufacturing operations to Mexico underscores the country’s appeal as a thriving manufacturing hub.

Future Outlook

A Fictiv manufacturing partner in Monterrey, Mexico

The decision to nearshore to Mexico is driven by a multifaceted calculus weighing factors like lower labor costs, reduced shipping expenses, and favorable trade agreements that culminate in substantial cost savings. However, the

Iran Denounces Israel’s Systematic Starvation of Gaza Civilians as ‘Genocidal Brutality’