– What role does leadership motivation play in the success and growth of Chinese companies with insider ownership?

Meet the Top Three Chinese Companies With Insider Ownership Driving Explosive Growth – Jolywood Suzhou Sunwatt Ltd Takes the Lead

In the world of Chinese companies, insider ownership can be a key driver of explosive growth. When leadership has a vested interest in the success of their company, they are often motivated to make decisions that will benefit both the organization and its shareholders. In this article, we’ll take a closer look at three Chinese companies with insider ownership that have been experiencing tremendous growth, with Jolywood Suzhou Sunwatt Ltd leading the way.

1. Tencent Holdings Ltd:

- Overview: Tencent Holdings Ltd is a Chinese multinational conglomerate holding company founded in 1998 by Pony Ma Huateng, a prominent figure in China’s tech industry.

- Insider Ownership: Pony Ma holds a significant stake in the company, with a passion for innovation and a focus on developing cutting-edge technology products and services.

- Growth: Tencent has experienced explosive growth in recent years, becoming one of the world’s largest technology companies by revenue. The company’s diverse portfolio includes social media, gaming, entertainment, and cloud services.

2. Huawei Technologies Co. Ltd:

- Overview: Huawei Technologies Co. Ltd is a global leader in telecommunications equipment and consumer electronics, founded in 1987 by Ren Zhengfei.

- Insider Ownership: Ren Zhengfei, the founder and CEO, has maintained strong control over the company, driving Huawei’s innovative approach to technology development.

- Growth: Huawei has seen significant growth in the past decade, becoming one of the world’s top smartphone manufacturers and a key player in the global 5G network rollout.

3. Jolywood Suzhou Sunwatt Ltd:

- Overview: Jolywood Suzhou Sunwatt Ltd is a leading supplier of solar energy products and solutions, specializing in photovoltaic technologies.

- Insider Ownership: The company’s founder and CEO, Dr. He Siyuan, has a strong commitment to driving innovation and sustainability in the solar industry, with a significant ownership stake in the company.

- Growth: Jolywood has seen rapid growth in recent years, expanding its market share and developing cutting-edge solar products that are in high demand globally.

Table 1: Comparison of Top Three Chinese Companies

| Company | Founder/CEO | Industry Focus | Recent Growth |

|---|---|---|---|

| Tencent Holdings Ltd | Pony Ma Huateng | Technology, Social Media, Gaming | Revenue growth, Expansion into new markets |

| Huawei Technologies Co. | Ren Zhengfei | Telecommunications, Electronics | Global 5G network rollout, Smartphone market |

| Jolywood Suzhou Sunwatt | Dr. He Siyuan | Solar Energy, Photovoltaics | Market share growth, Innovative product lineup |

Benefits and Practical Tips:

- **Investing in companies with strong insider ownership can be a wise decision, as leaders who have a significant stake in their company are more likely to make decisions that benefit shareholders.

- **When researching potential investments, look for companies with a track record of growth and innovation, as well as a strong commitment to sustainability and social responsibility.

- **Stay informed about industry trends and market dynamics to identify potential opportunities for growth and expansion in your investment portfolio.

Chinese companies with insider ownership like Jolywood Suzhou Sunwatt Ltd are driving explosive growth in their respective industries, thanks to visionary leaders who are invested in the success of their companies. By staying informed and making informed investment decisions, you can take advantage of the growth potential of these companies and see positive returns on your investment.

In the midst of fluctuating global markets, Chinese stocks have displayed resilience, driven by robust export data despite internal economic strains. This situation underscores the potential advantages of growth companies in China that have high insider ownership, as they possess unique strengths for navigating the intricate market environment.

Top 10 Growth Companies in China with High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

|---|---|---|

| Ningbo Sunrise Elc TechnologyLtd (SZSE:002937) | 24.3% | 27.7% |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 19% | 27.9% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.4% | 28.4% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 25.4% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| UTour Group (SZSE:002707) | 23% | 33.1% |

For a full list of 364 stocks showcasing rapid growth in Chinese companies with high insider ownership, visit our Fast Growing Chinese Companies With High Insider Ownership screener.

A Glimpse into Selected Companies

Jolywood (Suzhou) Sunwatt Co., Ltd.

- Simply Wall St Growth Rating: ★★★★★☆

- Overview: A global manufacturer of integrated photovoltaic products with a market capitalization of around CN¥6.25 billion.

- Operations: Revenue mainly stems from the photovoltaic industry, totaling CN¥10.84 billion.

- Insider Ownership: 19.4%

- Despite impressive growth forecasts, Jolywood faces challenges such as high debt levels and declining profit margins, raising liquidity concerns amid rapid expansion.

Beijing Relpow Technology Co., Ltd.

- Simply Wall St Growth Rating: ★★★★★☆

- Overview: A manufacturer of power supply products both domestically and internationally, with a market capitalization of approximately CN¥5.04 billion.

- Operations: Revenue is derived from power supply products sold in domestic and international markets.

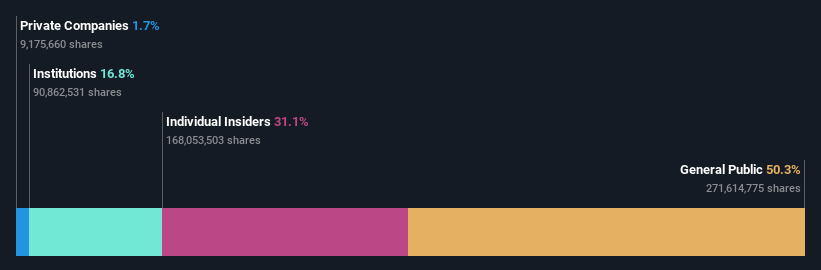

- Insider Ownership: 31.1%

- Despite recent challenges, Beijing Relpow anticipates a rebound, with strong growth projections and a focus on expanding its business scope. However, share price volatility and questionable dividend coverage pose risks.

BMC Medical Co., Ltd.

- Simply Wall St Growth Rating: ★★★★★☆

- Overview: A China-based company specializing in medical equipment and consumables for respiratory health, with a market capitalization of approximately CN¥5.58 billion.

- Operations: Revenue primarily generated from surgical and medical equipment sales, totaling around CN¥834.06 million.

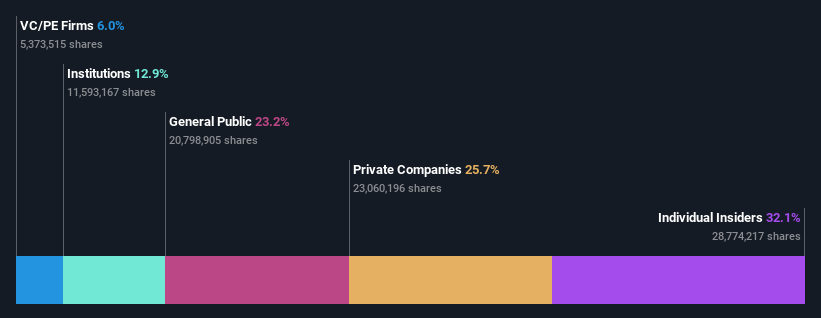

- Insider Ownership: 32.1%

- BMC Medical, with substantial insider ownership, aims for growth despite recent earnings and revenue declines. Analysts project robust growth rates, but concerns persist regarding dividend stability.

Next Steps

Exploring Other Opportunities

This analysis by Simply Wall St offers insights based on historical data and analyst forecasts. It does not constitute financial advice. For in-depth analysis encompassing fair value estimates, risks, dividends, insider transactions, and financial health, consider our comprehensive evaluation to determine if BMC Medical is over or undervalued.

Contact Us

If you have feedback or concerns regarding this article, reach out to us directly or email [email protected].