Risk Warning for Forex Trading:

Trading foreign exchange carries a significant level of risk and may not be suitable for all traders. The use of leverage increases the potential for loss. It is essential to assess your investment goals, experience, and risk tolerance before engaging in forex trading. There is a possibility that you could lose part or all of your initial investment, so it’s crucial to only invest funds that you can afford to lose. Take the time to educate yourself about the risks associated with forex trading and consider seeking guidance from an independent financial or tax advisor if you have any uncertainties.

Advisory Notice:

It’s important to note that FOREXLIVE™ does not provide investment advice. Instead, FOREXLIVE™ offers references and links to news, blogs, and other economic and market information for educational purposes only. The opinions expressed in these sources should be carefully evaluated within the context of your individual analysis and decision making process. It’s vital to recognize that past performance is not indicative of future results. Before investing funds or opening an account with any Forex dealer, carefully review all claims and representations made by advisors, bloggers, money managers, and system vendors.

Disclaimer:

Seek expert advice: Consult with experienced forex traders, analysts, and industry professionals to gain valuable insights and guidance on navigating the aftermath of the intervention.

Breaking News: Major FX Intervention in Asia Market Unveiled by Forexlive

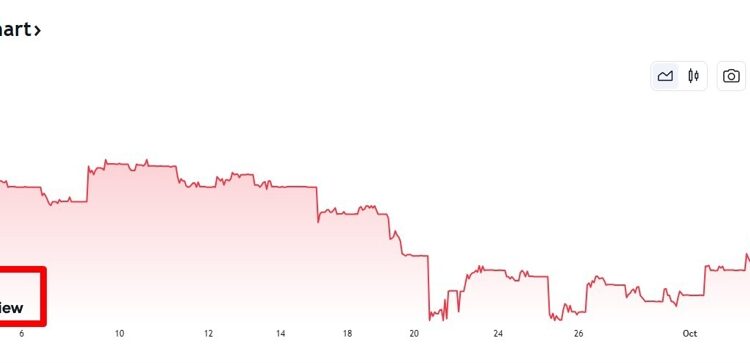

Forex traders and market enthusiasts have been buzzing with excitement and speculation following the breaking news of a major FX intervention in the Asia market unveiled by Forexlive. The announcement has sent shockwaves through the financial world and has the potential to significantly impact currency exchange rates, trading strategies, and market sentiment.

What is FX intervention and why is it significant?

FX intervention, also known as currency intervention, is the deliberate action taken by a central bank or government to influence the value of their currency in the foreign exchange market. This can involve buying or selling large quantities of a particular currency to stabilize its value or achieve specific economic objectives. The intervention can have both short-term and long-term effects on currency exchange rates, trade balances, and overall economic stability.

Forexlive’s announcement of a major FX intervention in the Asia market has captured the attention of traders and analysts worldwide due to its potential to disrupt established market trends and trigger significant movements in currency pairs. This development is of particular interest to those actively engaged in forex trading as it presents an opportunity to capitalize on potential volatility and profit from swift market movements.

Keywords: FX intervention, Asia market, Forexlive, currency exchange rates, forex trading, foreign exchange market, currency pairs, market volatility

How does this news impact forex traders?

For forex traders, the news of a major FX intervention in the Asia market demands close attention and careful consideration of its potential implications. Given the inherent volatility and sensitivity of currency markets to significant events, traders must adapt their strategies and risk management approaches to effectively navigate the evolving landscape.

The unveiling of the FX intervention could lead to increased market uncertainty, heightened price fluctuations, and amplified trading volumes in affected currency pairs. Traders should stay updated on relevant news, monitor market sentiment, and assess the potential impact on their existing positions to make informed trading decisions in response to this development.

Keywords: forex traders, FX intervention, market uncertainty, trading strategies, market sentiment, currency pairs, risk management, trading decisions

Practical tips for navigating the aftermath of the intervention

In the aftermath of a major FX intervention, traders can benefit from adopting a proactive approach and leveraging relevant insights to optimize their trading activities. Here are some practical tips for navigating the aftermath of the intervention:

Stay informed: Keep abreast of developments, market commentary, and expert analysis to gain a comprehensive understanding of the intervention’s impact and potential implications.

Assess risk exposure: Evaluate your portfolio’s exposure to currency pairs affected by the intervention and consider

The information provided on this website is intended as general market commentary rather than specific investment advice or recommendations. FOREXLIVE™ does not guarantee the completeness or accuracy of all available public information regarding a particular market or security presented on its website. Therefore, FOREXLIVE™ explicitly disclaims any responsibility for potential losses arising directly or indirectly from reliance on such information.

Compensation Disclosure:

FOREXLIVE™ may receive compensation from advertisers based on user interaction with advertisements displayed on the website.

Finance Magnates CY Limited