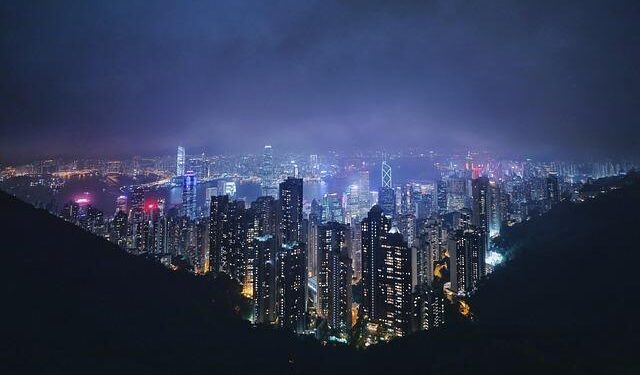

In a important development for cryptocurrency enthusiasts and investors, Hong Kong has officially recognized Bitcoin and Ether as valid assets for demonstrating wealth in the submission process for investment visas.This landmark decision marks a pivotal moment in the integration of digital currencies into conventional financial frameworks, reflecting the region’s evolving stance on cryptocurrency amid a global trend toward greater acceptance. As Hong Kong continues to position itself as a leading financial hub, this change not only opens new avenues for foreign investment but also underscores the growing legitimacy of cryptocurrencies in the mainstream economy. In this article, we will explore the implications of this decision for prospective investors, the broader impact on Hong Kong’s financial ecosystem, and the regulatory landscape that surrounds digital assets in the territory.

Understanding Hong Kongs New Investment Visa Policy for Cryptocurrency Holders

In a landmark decision, Hong Kong has officially recognized Bitcoin and Ether as legitimate assets for proving wealth in the context of its new investment visa policy. This pivotal move aims to attract global investors, particularly those immersed in the rapidly evolving cryptocurrency landscape. By allowing cryptocurrency holdings as proof of financial capability, the 香港 government is sending a clear message: it seeks to become a leading hub for crypto innovation and investment, encouraging digital asset holders to contribute to its economy.

Potential applicants are required to adhere to specific guidelines set forth by the authorities. Key points include:

- Verification of Assets: investors must provide documentation supporting their crypto holdings,including wallet addresses and transaction histories.

- Minimum Investment Threshold: A stipulated amount in cryptocurrencies will be needed to qualify,signifying serious commitment.

- Duration of Stay: The investment visa will grant a temporary residence permit,renewable based on continued investment.

| Criteria | Description |

|---|---|

| Assets Accepted | Bitcoin, Ether |

| Minimum Investment | $1 million equivalent in crypto |

| Application Process | Document submission for asset verification |

The Role of Bitcoin and Ether in Wealth verification for Immigration

The recent confirmation by Hong Kong authorities regarding the acceptance of Bitcoin and Ether as valid assets for proving wealth in investment visa applications marks a significant shift in the immigration landscape. This move recognizes the growing importance of cryptocurrencies in global finance and wealth management. Individuals seeking to immigrate through investment can now include these digital assets as part of their financial portfolio, showcasing their liquidity and value. The versatility offered by digital currencies allows applicants to tap into a broad spectrum of wealth verification methods,which can streamline the immigration process considerably.

Moreover, the integration of cryptocurrencies into wealth verification frameworks introduces new dimensions to due diligence and financial assessments. By accepting Bitcoin and Ether, Hong Kong is aligning its immigration policies with contemporary financial practices that reflect global economic shifts. The criteria for assessing the value of these digital currencies will likely involve factors like market capitalization, transaction volume, and the asset’s past performance. Below is a simple table outlining the general advantages of using Bitcoin and Ether for wealth verification:

| Advantages | Bitcoin | Ether |

|---|---|---|

| Market Recognition | Widely accepted and recognized globally | Strong presence in decentralized applications and finance |

| Liquidity | Highly liquid and can be quickly converted to fiat | growing liquidity with many trading platforms |

| Value Stability | Established track record as a store of value | Volatility mitigated by increasing networks and utility |

Implications of the Policy for International Investors

The recent policy announcement from Hong Kong regarding the acceptance of Bitcoin and Ether as valid forms of wealth proof for investment visas marks a significant shift in the financial landscape of the region. For international investors, this development not only enhances the attractiveness of Hong kong as a global financial hub but also streamlines the visa application process for those looking to invest in the local market. With its robust regulatory framework, Hong Kong is positioning itself as a forward-thinking destination for digital asset holders. International investors now have the ability to leverage their cryptocurrency holdings to gain residency, thereby facilitating easier access to business opportunities in one of Asia’s most dynamic economies.

Moreover, this policy could catalyze a surge in cryptocurrency adoption and investment within the region, leading to increased market liquidity and innovation. As international investors consider their strategic options, the implications of using cryptocurrencies for demonstrating financial capacity may lead to the following outcomes:

- Increased Investment: More foreign capital inflow as investors navigate the benefits of this innovative pathway.

- Diversity in Asset Management: A rise in less traditional asset management strategies as investors seek to include digital currencies in their portfolios.

- Regulatory evolution: Encouragement for other jurisdictions to consider similar policies, possibly resulting in a more competitive global investment landscape.

Navigating the Application Process for the Investment Visa

As investors eye the lucrative opportunities in Hong Kong, understanding the application process for the investment visa is crucial. With the recent confirmation that cryptocurrencies like Bitcoin and Ether can now serve as proof of wealth, prospective applicants should familiarize themselves with the requisite documentation and steps required for a successful application. The process predominantly involves demonstrating a clear investment plan and financial stability, alongside valid identification documents. This update presents a significant shift in the approach toward digital assets, encouraging applicants to leverage their cryptocurrency holdings effectively.

Applicants should make sure to prepare the following key components:

- Proof of Investment: Provide details of your investment plan,including amounts and intended assets.

- Verification of Cryptocurrency Holdings: Document your Bitcoin and Ether assets through verified wallets and exchanges.

- Financial Statements: Submit bank statements or financial reports verifying your overall financial situation.

- Business Plan: If applicable, include a detailed plan outlining how your investment will contribute to Hong Kong’s economy.

additionally, applicants should be aware of crucial processing times and possible interviews as part of the application protocol. Below is a simple overview of the key steps in the investment visa application process:

| Step | description |

|---|---|

| 1. Prepare Documents | Gather all necessary paperwork including proof of wealth. |

| 2. Submit Application | Send your completed application form and documents to the relevant authorities. |

| 3. Interview (if required) | Attend an interview to discuss your application and investment plans. |

| 4. Await Decision | receive notification about your application status. |

Potential Impact on Hong Kongs financial Ecosystem

Allowing cryptocurrencies like bitcoin and Ether to serve as proof of wealth for investment visas could substantially reshape Hong Kong’s financial landscape.This initiative could attract a new wave of investors who may have previously been deterred by complexities surrounding traditional financial documentation. By embracing digital assets, Hong Kong is positioning itself as a forward-thinking financial hub, potentially increasing its competitiveness on the global stage.

the integration of cryptocurrency into the investment visa process can stimulate various sectors within Hong Kong’s economy. It encourages not only the influx of funds but also fosters innovation and the development of blockchain-related businesses.The key impacts to consider include:

- Increased Investment: More investors may seek to relocate to Hong Kong to benefit from favorable economic conditions.

- Market Expansion: The local crypto market could see exponential growth due to increased legitimacy.

- Regulatory Evolution: This move may prompt regulators to evolve existing frameworks to ensure a secure environment for crypto transactions.

| Impact Area | Potential Change |

|---|---|

| Investment Inflow | higher risk capital from crypto investors |

| economic Diversification | Growth in crypto startups |

| Technological Advancements | Innovation in financial services |

Expert Perspectives on Future Developments in Crypto Regulation

Industry experts agree that the recent affirmation by Hong kong’s regulatory bodies allowing Bitcoin and Ether as proof of wealth for investment visas represents a significant step in the evolution of cryptocurrency regulation. This move not only enhances the legitimacy of digital assets but also signals a potential shift toward a more inclusive framework for crypto assets worldwide. Analysts suggest that this policy could pave the way for a broader acceptance of cryptocurrencies as viable financial instruments,which may encourage other jurisdictions to follow suit in establishing clear and favorable regulatory pathways.

Furthermore, the implications of such regulations extend beyond mere investment opportunities. The recognition of cryptocurrencies in formal financial systems could lead to enhanced investor protections and increased market stability. Experts anticipate a growing trend of integrating blockchain technology within traditional financial processes, resulting in a more interconnected economy. key points for consideration include:

- Clarity: Enhanced regulatory clarity could reduce fraud and increase consumer confidence.

- Innovation: With supportive policies, there might potentially be a surge in technological advancements within the blockchain ecosystem.

- Global Standards: As more regions adopt similar frameworks, a global standard for crypto regulation may emerge.

To Conclude

Hong Kong’s bold move to recognize Bitcoin and Ether as legitimate means to demonstrate wealth for investment visa applications marks a significant shift in the city’s regulatory landscape. This development not only highlights the growing acceptance of cryptocurrencies in mainstream finance but also positions Hong Kong as a forward-thinking hub for digital assets. As global interest in crypto investment continues to surge, this policy could attract a new wave of entrepreneurs and investors looking to tap into the vibrant opportunities that the city offers. as the landscape evolves, stakeholders will be watching closely to see how this initiative influences both local and international perspectives on cryptocurrency regulations and investment frameworks.