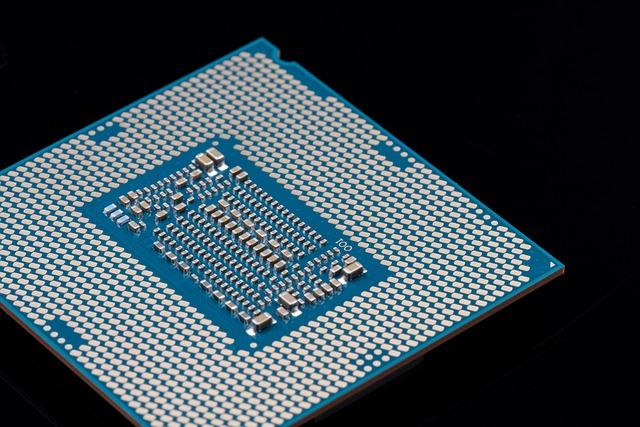

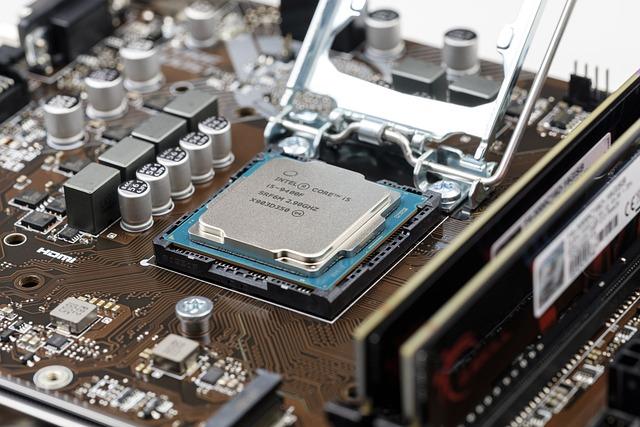

In a notable expansion of its investment portfolio, Intel’s Chinese subsidiary is set to enhance its stake in the telecoms division of Luxshare Precision Industry Co., a key supplier to Apple. This strategic move highlights the ongoing dynamics of technology partnerships in the region and underscores Intel’s commitment to strengthening its presence in the rapidly evolving telecommunications sector. As global supply chains increasingly intertwine, this investment not onyl emphasizes the significance of Luxshare within the tech ecosystem but also raises questions about the broader implications for U.S. companies operating in China amid escalating geopolitical tensions. In this article, we delve into the details of Intel’s investment, the role of Luxshare in the Apple supply chain, and the potential ramifications for both companies in the context of the current global market landscape.

Intel’s Strategic Investment in Luxshare’s Telecom Subsidiary

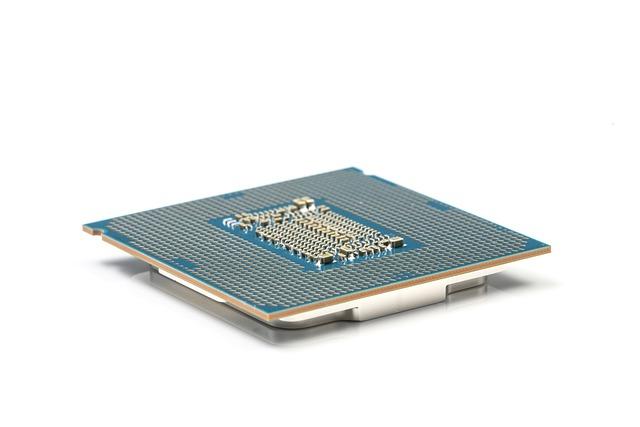

In a notable maneuver within the telecommunications landscape,Intel’s China arm has decided to deepen its ties with Luxshare,a key supplier to Apple,by investing in its telecom subsidiary. This strategic alliance underlines the growing importance of telecommunications infrastructure in the tech sector, notably as demand surges for enhanced connectivity solutions. Intel’s decision underscores a commitment to expanding its portfolio beyond traditional semiconductor markets, allowing it to tap into Luxshare’s vast networks and capabilities.

The investment strategy is expected to foster innovation and accelerate the development of advanced telecom solutions. Intel is particularly interested in leveraging Luxshare’s expertise in manufacturing and supply chain management,thereby strengthening its position in a highly competitive market.Key benefits of this partnership include:

- Enhanced R&D Capabilities: Collaborative projects to innovate next-gen telecom technology.

- Market Expansion: Greater access to the rapidly growing Chinese telecom sector.

- Supply Chain Efficiency: Streamlined operations through Luxshare’s established networks.

| Aspect | Intel | Luxshare |

|---|---|---|

| Core Business | Semiconductors | Electronics Manufacturing |

| Focus Area | Telecommunications | Telecom Subsidiaries |

| Investment Objective | Market Positioning | Innovation Acceleration |

Implications of Intel’s Move for China’s Tech Landscape

The recent investment by Intel’s China arm into the telecoms subsidiary of Luxshare marks a important shift in the dynamics of the Chinese tech sector, which has been undergoing rapid conversion amid geopolitical tensions. This move could signal a renewed commitment from foreign technology firms to tap into china’s vast market potential, despite the existing challenges posed by regulatory scrutiny and trade restrictions. intel’s strategic decision to align with a major Apple supplier like Luxshare may catalyze further collaborations between domestic firms and international technology giants, fostering innovation while also presenting competition for local companies. Key implications of this partnership include:

- Increased competition: Domestic telecom companies may need to enhance their offerings to compete with Luxshare’s innovations that come from Intel’s backing.

- Supply chain diversification: Companies could increasingly seek partnerships with more foreign entities, reducing reliance on traditional supply chains.

- Investment influx: Foreign investments might increase, encouraging more technology transfer and expertise sharing.

Furthermore, this partnership is indicative of a broader trend where foreign technology companies are actively seeking footholds in China amidst the changing geopolitical landscape. The investment could lead to enhanced technological capabilities for Luxshare and strengthen its position in global supply chains, especially as Apple continues to diversify its supplier network. As the lines between competition and collaboration blur, it becomes essential for local enterprises to innovate at a faster pace and explore new alliances. A simplified overview of these emerging trends can be seen in the table below:

| Trend | Potential Impact |

|---|---|

| Increased Collaboration | Potential for innovative solutions through shared expertise |

| Regulatory Adjustments | Possible easing of restrictions for foreign investments |

| Focus on R&D | Growth in research and development initiatives among local firms |

analyzing the Relationship Between Intel and Luxshare

The recent investment by Intel’s China arm into the telecoms subsidiary of Luxshare highlights a strategic partnership that could reshape the landscape of mobile technology and supply chain dynamics. Luxshare, primarily known as an Apple supplier, has been diversifying its portfolio, and Intel’s interest underscores the potential benefits of collaboration.Both companies are poised to leverage their strengths—Intel’s processing power and Luxshare’s manufacturing capabilities—aiming for innovation in telecommunications and consumer electronics. This synergy could enhance product offerings and may lead to groundbreaking advancements in 5G technology, chipsets, and connectivity solutions.

Industry analysts suggest that this collaboration may signify a shift towards domestically driven technological advancements, particularly amid ongoing geopolitical tensions and supply chain disruptions. Notable factors influencing this investment include:

- Increased Demand: The rising global demand for high-speed internet and connected devices.

- Cost Efficiency: Streamlining supply chains to mitigate rising production costs.

- Innovation Opportunities: Potential for collaborative R&D initiatives that drive innovation.

To better visualize the competitive landscape, consider the following comparison table highlighting key metrics of both companies:

| Company | Revenue (2022) | Market Focus | Recent Developments |

|---|---|---|---|

| Intel | $63 billion | Processors, Data Centers | New 5G chip launch |

| Luxshare | $10 billion | Telecommunications, Electronics | Expansion into AI technology |

Potential Benefits for Apple’s Supply Chain Dynamics

The investment by Intel’s China arm in Luxshare’s telecoms subsidiary has the potential to considerably enhance Apple’s supply chain dynamics.By partnering with a leading Apple supplier, intel not only reinforces its commitment to the telecom sector but also creates opportunities for improved component integration and innovation. this cooperation could enable Luxshare to deliver more advanced technologies, ensuring that apple remains at the forefront of market trends while mitigating risk factors related to supply chain disruptions.

Additionally,the collaboration is highly likely to foster a more resilient supply chain framework that emphasizes efficiency and reliability. Benefit-wise, one can expect:

- Streamlined Processes: Enhanced synergies between production and delivery.

- Cost Efficiency: Reduced operational costs through integrated technology solutions.

- Speed to Market: Faster rollout of new devices equipped with cutting-edge telecom features.

With these advancements, Apple’s ability to adapt to changing market demands and innovate rapidly could be significantly bolstered, potentially leading to sustained competitive advantages in the tech industry.

recommendations for Stakeholders in the Semiconductor Industry

As stakeholders in the semiconductor sector navigate a rapidly changing landscape,it is essential to adopt a proactive approach towards investment strategies and partnerships. Companies should focus on fostering strategic collaborations that leverage the capabilities of both local and global players, ensuring a balanced supply chain that mitigates risks associated with geopolitical tensions. Emphasizing innovation within manufacturing processes is also critical, enabling firms to enhance their competitive edge while minimizing costs. The following recommendations can help stakeholders optimize their operations:

- Diversify supply chains to reduce dependency on specific regions.

- Invest in R&D to stay ahead of technological advancements.

- Pursue partnerships with emerging technology firms for innovation.

Additionally, stakeholders are encouraged to closely monitor regulatory changes and market dynamics in regions like China, as these factors will influence strategic decisions and investment potential.Regularly assessing market opportunities can lead to enhanced growth trajectories. To facilitate informed decision-making,consider the following table highlighting key market trends and their implications:

| market Trend | Implication for Stakeholders |

|---|---|

| Increased demand for 5G technology | Possibility for investment in telecom infrastructure. |

| Growing emphasis on sustainability | Need for eco-friendly manufacturing practices. |

| Rising interest in AI applications | Potential for collaboration with software companies. |

Future Outlook for Telecom Investments in China’s Market

The telecom sector in China is poised for a significant transformation, driven by advancements in technology and increasing investment from both local and international players. Intel’s strategic investment in Luxshare’s telecom subsidiary underscores a growing trend where tech giants seek to capitalize on the expanding telecommunications infrastructure within the country. as 5G networks continue to roll out, the demand for innovative solutions tailored to enhance connectivity will only intensify. This presents lucrative opportunities for companies looking to develop cutting-edge applications, hardware, and services that can operate within this evolving landscape.

Additionally, the landscape of telecom investments is likely to be influenced by various factors, including government policies, market competition, and the increasing emphasis on sustainability. Key areas expected to attract investment include:

- 5G Infrastructure: Continued expansion and optimization of networks.

- R&D in Next-gen Technologies: Focus on AI, IoT, and edge computing.

- cybersecurity Solutions: Increased emphasis on secure communications.

- Green Technology Initiatives: Sustainable practices and eco-friendly innovations.

To further illustrate the investment landscape, the following table summarizes key players and their strategic focus areas:

| Company | Investment Focus |

|---|---|

| Intel | Telecom infrastructure and next-gen technologies |

| Luxshare | Telecom equipment and supply chain solutions |

| Huawei | 5G network expansion and R&D |

| Alibaba Cloud | AI and data management for telecom |

Final Thoughts

Intel’s strategic investment in the telecoms subsidiary of Luxshare underscores the growing interdependence between global technology players and the evolving landscape of the semiconductor industry.As companies like Intel seek to enhance their supply chains and expand their influence in key markets, this partnership highlights the competitive dynamics at play in the rapidly changing tech habitat. With China remaining a vital player in the global electronics supply chain, such investments not only pave the way for potential innovation and collaboration but also reflect the intricate balance between economic interests and geopolitical considerations. As developments in this sector continue to unfold, stakeholders will be closely monitoring how these alliances shape the future of telecommunications and semiconductor manufacturing.