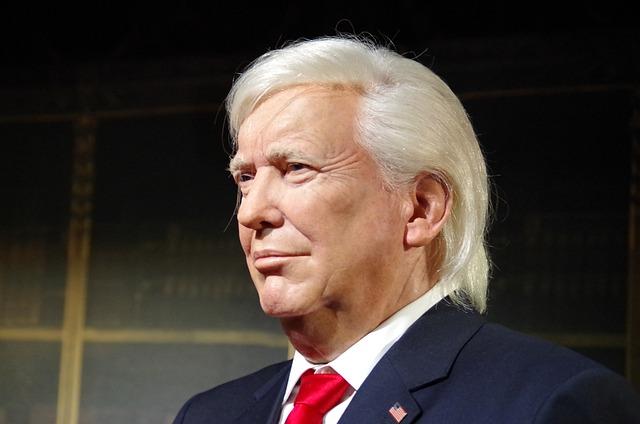

In recent years, global trade dynamics have been significantly shaped by policies enacted by major economies, with the United States taking the led. Among these policies, former president Donald Trump’s steel tariffs stand out as a contentious issue, stirring debate over thier broader implications for international markets. As South Korea emerges as a key player in the global steel industry, the ramifications of these tariffs are notably pronounced. This article delves into the potential consequences of Trump’s steel tariffs on South Korea’s economy, exploring how they could undermine the nation’s industrial backbone, disrupt trade relationships, and challenge the resilience of a vital sector. With a closer look at both the immediate effects and long-term implications, we aim to unpack the complex interplay between U.S. trade policy and South Korea’s economic stability.

Impact of Steel Tariffs on South Korean Industries

The implementation of steel tariffs by the Trump governance is poised to have critically important repercussions for South Korean industries, particularly in sectors heavily reliant on imported steel. This protectionist measure threatens to trigger a domino effect that could reshape the competitive landscape.Industries most affected include:

- Automotive Manufacturing: South Korea’s third-largest export sector heavily depends on quality steel for vehicle production.

- Shipbuilding: With many local shipbuilders sourcing steel from global suppliers, increased costs could hinder their ability to compete internationally.

- Construction: Rising steel prices could inflate overall project budgets, delaying infrastructural developments.

Furthermore, the long-term implications of these tariffs may lead to a strategic shift in global supply chains. As South Korean firms face elevated prices and dwindling access to essential materials, a potential relocation of operations could become necessary. This change not only threatens local jobs but also risks alienating foreign investment. Key considerations for south Korea include:

- Innovation and Adaptation: Industries must pivot towards alternative materials or advanced technologies.

- Diversification: Efforts should be made to reduce reliance on foreign steel sources.

- Diplomatic Engagement: Strengthening trade relations with other countries to mitigate the negative impacts.

Economic Repercussions for Key manufacturing Sectors

The imposition of steel tariffs by the Trump administration has created ripples across global markets,particularly impacting South Korea’s key manufacturing sectors. As one of the largest producers of automobiles and electronics,South Korean industries heavily rely on imported raw materials,including steel. The tariffs have not only inflated raw material costs but have also triggered a chain reaction affecting overall production costs. manufacturers are faced with a tough choice: pass on these costs to consumers or absorb the losses, both of which could destabilize their market position.

The economic consequences extend beyond immediate financial impacts; they threaten to hamper innovation and competitiveness in the global arena. Key sectors are likely to experience a contraction due to the reduced capacity for investment in technology and workforce development. The potential outcome is a cyclical detriment to the economy, including:

- Job Losses: decreased production can lead to layoffs and reduced hiring, impacting livelihoods.

- Export Challenges: South Korea’s global standing as a manufacturing hub is jeopardized with increased costs passed to international buyers.

- Supply Chain Disruptions: Tariffs could create bottlenecks, hindering the flow of materials needed for production.

Strategic Responses from the South Korean Government

In the face of president Trump’s steel tariffs, the south Korean government has initiated a multi-pronged strategy to mitigate potential economic fallout. This approach encompasses diplomatic negotiations, industry support programs, and a keen emphasis on diversification of trade partnerships. Key actions include:

- Engagement with Trade Alliances: South Korea is actively seeking to strengthen ties with other Asian nations and the European Union to counterbalance the economic effects of tariffs.

- Supporting Domestic Industries: Financial incentives and subsidies are being provided to local steel manufacturers impacted by these tariffs to ensure their competitiveness.

- Monitoring Market Dynamics: The government has established task forces to continuously monitor the market and assess the impact of tariffs on local businesses.

Furthermore, the South Korean government is exploring legal routes through the World Trade Organization (WTO) to challenge the tariffs imposed by the U.S. This legal action aims not only to protect domestic industries but also to signify South Korea’s commitment to maintaining a rules-based international trading system. The following table summarizes key aspects of South Korea’s strategic responses:

| strategy | Description |

|---|---|

| Diplomatic Outreach | Strengthening trade relations with alternative partners. |

| Industry Assistance | Providing subsidies to local steel manufacturers. |

| Legal Challenges | Utilizing the WTO to contest U.S. tariffs. |

Long-term Implications for South Korea’s Trade Relations

The imposition of steel tariffs by the trump administration significantly alters the landscape of South Korea’s trade relations, pushing the country to reconsider its position in global markets. As one of the world’s major steel producers, South Korea is particularly vulnerable to such measures, which not only threaten its pivotal steel industry but also ripple through interconnected sectors, including automotive and shipbuilding. The long-term implications are diverse and potentially detrimental, including:

- Increased production costs for domestic manufacturers.

- Loss of competitive edge in key markets, particularly in the U.S.

- Heightened tension with conventional trading partners.

Furthermore, these tariffs could accelerate shifts in supply chains, prompting South Korean firms to seek alternative sources for materials or to relocate production to countries with more favorable trade conditions. This scenario could lead to:

- A decreased reliance on U.S. imports and a pivot towards other nations.

- Potential retaliatory measures from South Korea, impacting U.S. goods.

- long-term reconfiguration of global trade alliances, with South Korea strengthening ties in Asia-Pacific regions.

recommendations for Diversifying supply Chains

Considering increasing global uncertainties and challenges posed by tariffs,businesses must prioritize the diversification of their supply chains to enhance resilience. Key strategies could include:

- Geographical diversification: Expanding supplier networks across different regions to mitigate risks associated with political tensions and economic disruptions.

- Supplier Base Expansion: Engaging multiple suppliers for essential materials to ensure that production can continue smoothly even if one supplier faces challenges.

- Investment in Local Production: Exploring opportunities for local sourcing to reduce dependency on foreign suppliers and potentially lower logistics costs.

Moreover,leveraging technology to create a more agile supply chain can aid organizations in adapting to new market dynamics swiftly. This can be accomplished through:

- Data analytics: Utilizing data-driven insights to forecast demand and manage inventory effectively.

- Blockchain Technology: Implementing blockchain for improved clarity and traceability within the supply chain, fostering trust among stakeholders.

- Collaborative Platforms: Adopting digital platforms that enable real-time collaboration with suppliers and logistics partners.

Assessing Global Reactions and Future Trade Policies

The imposition of steel tariffs by the Trump administration has prompted diverse reactions on the global stage, reflecting a spectrum of economic interests and strategic alliances. countries heavily reliant on steel imports, such as South Korea, have raised alarms over the implications of these tariffs. Critics argue that such protectionist measures could lead to increased costs for manufacturers and consumers alike, potentially stifling economic growth. Moreover, the retaliatory measures from other nations may escalate the situation, creating a vicious cycle of trade conflicts that could disrupt established supply chains and further isolate economies. Key responses include:

- Calls for diplomatic solutions from affected countries.

- Increased negotiations for trade deals to mitigate adverse effects.

- Possible shifts toward alternative markets and suppliers.

As nations grapple with the broader implications of these tariffs, the future of global trade policies remains uncertain. South Korea, in particular, is at a crossroads, with its economic backbone hinging on the steel industry and exports. The potential for a trade war looms large, compelling South Korean policymakers to rethink their strategies in international trade relations. In this context, the urgency to diversify trade partnerships and invest in domestic capabilities has never been clearer.A strategic review of trade dependencies could lead to:

| Future Strategies | Focus Areas |

|---|---|

| Market Diversification | Exploration of new trade agreements |

| Domestic Investment | Enhancing local production capacities |

| Technological Advancement | Innovation in steel manufacturing |

in Conclusion

the implications of Trump’s steel tariffs extend far beyond American borders, casting a long shadow over South Korea’s economic landscape. The tariffs jeopardize the stability of a key industry and threaten to disrupt established supply chains that are critical to the nation’s ongoing growth. As the South Korean government grapples with these challenges,the potential for increased trade tensions with the United States poses significant risks not only to South Korea’s economy but also to broader global trade relationships. the unfolding effects of these tariffs will require careful monitoring, strategic responses, and perhaps a reevaluation of international trade partnerships moving forward. South Korea’s resilience will be tested, and the path it takes could serve as a litmus test for other nations facing similar dilemmas in an increasingly protectionist world.