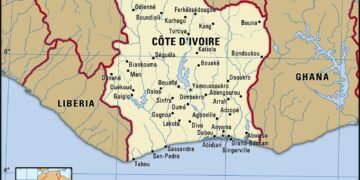

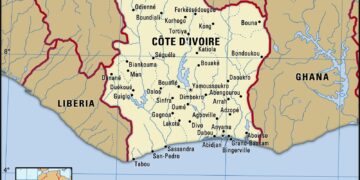

In recent days, cocoa prices have experienced a notable uptick, driven by growing concerns over potential disruptions in exports from Côte d’Ivoire, the world’s leading cocoa-producing nation. As reports emerge of possible supply tightness due to adverse weather conditions and logistical challenges, market analysts are recalibrating their forecasts, anticipating that these factors could considerably impact global cocoa availability. According to Bloomberg, investors and traders are responding to these developments with heightened vigilance, signaling a possible shift in the dynamics of the cocoa market. This article explores the implications of Ivorian export uncertainties on cocoa prices, the broader effects on the chocolate industry, and the factors contributing to this critical situation.

Cocoa Market Reaction to Export Concerns in Ivory Coast

The cocoa market is reacting strongly to growing concerns over export disruptions from the Ivory Coast, the world’s largest cocoa producer.Recent reports indicate that logistical challenges and adverse weather conditions may significantly impede the flow of cocoa beans from this key region.As traders assess the potential impact on supply, prices have begun to surge amidst fears of tightening availability. Factors influencing this reaction include:

- Increased transportation issues in key export zones

- Possible adverse weather forecast affecting the harvest

- Rising demand from global markets outpacing current supply levels

Market analysts suggest that the resulting supply crunch could lead to a buyer’s frenzy, pushing cocoa futures to potentially record highs. As stakeholders monitor production reports more closely, many are opting to hedge their bets by securing contracts early, further driving up the trading volume. Below is a snapshot of the current cocoa futures prices influenced by Ivorian export concerns:

| Date | Futures Price (USD) | Change (%) |

|---|---|---|

| Oct 1, 2023 | $2,500 | +3.5% |

| Oct 15, 2023 | $2,600 | +4.0% |

Analyzing the Factors Behind Ivorian Export Slowdown

The recent downturn in Ivorian exports has sparked concern in the global cocoa market, as Côte d’Ivoire is the leading supplier of cocoa beans. Several interrelated factors have contributed to this slowdown. Among these are:

- Unfavorable Weather Conditions: Droughts and erratic rainfall patterns have adversely affected crop yields, limiting the amount of cocoa produced.

- Farmers’ Strikes: Labour disputes and strikes among farmers have disrupted harvest operations, further complicating supply lines.

- Infrastructure Challenges: Poor transportation networks and logistics issues have delayed the export process, preventing timely deliveries to international markets.

Additionally, market fluctuations driven by rising costs of production and decreased investment in the agricultural sector have also played a pivotal role. The following table highlights the comparative impact of these challenges:

| Factor | Impact Level |

|---|---|

| unfavorable Weather | High |

| Farmers’ Strikes | Medium |

| Infrastructure Challenges | High |

| Production Costs | Medium |

As global demand for cocoa remains robust, understanding and addressing these exporting challenges will be crucial for Côte d’Ivoire to stabilize and potentially enhance its production capacity in the future.

Impact of Supply Tightening on Global Cocoa Prices

The recent tightening of supply due to reduced export activity from Côte d’ivoire has substantially influenced global cocoa prices. As the world’s leading cocoa producer,fluctuations in Ivorian output can create ripples throughout the global market. Several key factors are attributing to this scenario:

- Increased demand: A persistent rise in chocolate consumption, particularly in emerging markets, has heightened the competition for cocoa beans.

- Weather conditions: Adverse weather patterns in West Africa have limited the harvest yield, further exacerbating supply constraints.

- Government regulations: Recent initiatives aimed at improving labor conditions may inadvertently limit the volume of cocoa available for export.

these elements combined have led to notable price surges, forcing manufacturers to either absorb costs or pass them onto consumers. According to recent market analysis,cocoa prices have seen an increase of nearly 15% over the past month alone. This escalation reflects a broader trend in commodity pricing influenced by market sentiment and supply chain challenges.

| Period | Cocoa Price (USD/ton) |

|---|---|

| January 2023 | 2,500 |

| February 2023 | 2,600 |

| September 2023 | 2,850 |

| Current (October 2023) | 2,950 |

Strategic Recommendations for Cocoa Investors Amid Market Volatility

As concerns grow over the potential tightening of cocoa supplies due to slowing exports from Ivory Coast, investors must adopt a proactive approach to navigate the current market volatility. To mitigate risks and leverage potential opportunities, consider the following strategies:

- Diversification: Investors should explore diversifying their portfolios to include related commodities or stocks in the food sector, which may provide a buffer against fluctuations in cocoa prices.

- Hedging: Utilizing options and futures contracts can help protect investments against sudden price declines stemming from unexpected supply constraints.

- Market Monitoring: keeping a close eye on export reports and weather patterns in the Ivory Coast and other major cocoa-producing regions will provide critical insights for timely decision-making.

Furthermore, a deeper analysis of the supply chain dynamics is essential to understanding long-term trends in cocoa pricing. The following table outlines key factors affecting cocoa supply:

| Factor | Impact on Supply |

|---|---|

| Deregulation in export Markets | Can lead to increased competitiveness but may result in short-term supply hiccups. |

| Climate Change Effects | Potentially decreases yield due to adverse weather conditions, impacting overall production capacity. |

| Political Stability in Producing Regions | Unrest can disrupt logistical operations, severely impacting export quantities. |

Future Outlook for Cocoa Supply and Demand Dynamics

The cocoa market is poised for significant transformation as concerns mount over the potential impact of declining exports from Côte d’Ivoire, one of the world’s leading cocoa producers. Supply disruptions due to weather conditions, labor shortages, and fluctuating geopolitical factors could intensify in the coming months, further complicating the global supply chain. Key elements influencing this dynamic include:

- Climate Change: Increased temperatures and unpredictable rainfall patterns may adversely affect cacao pod production.

- Labor Issues: Dependency on seasonal labor raises vulnerability to strikes and socio-economic unrest in producing regions.

- Global Demand Shifts: As chocolate companies pivot towards enduring and ethical sourcing,the demand for certified cocoa may outstrip supply.

Conversely, the demand side of cocoa consumption remains robust. Emerging markets, particularly in Asia and Africa, are showing an increasing appetite for chocolate, which could amplify competition for limited available supplies.The following factors may shape future demand dynamics:

| Region | Projected Growth Rate (2024-2028) | key Drivers |

|---|---|---|

| Asia-pacific | 12% | Urbanization, changing consumer preferences |

| north America | 5% | Health trends favoring dark chocolate |

| Europe | 3% | Sustainability initiatives and luxury markets |

As supply constraints emerge from Côte d’Ivoire, the resultant scarcity could drive prices higher, compelling manufacturers to explore option sourcing strategies or innovative product formulations. A delicate balance between maintaining competitive pricing and ensuring quality will be critical for industry stakeholders navigating this evolving landscape.

Navigating Market Uncertainties: Insights for Stakeholders

The cocoa market is experiencing significant fluctuations as stakeholders respond to emerging concerns regarding the stability of Ivorian exports. With forecasts indicating a potential slowdown in the Ivory Coast, the world’s largest cocoa producer, the industry is bracing for tighter supplies. This situation is further exacerbated by climatic challenges and labor disruptions, raising red flags for traders and manufacturers alike. Amid these uncertainties,cocoa prices have shown upward momentum,reflecting a growing apprehension about future availability and its implications on global supply chains.

In light of these developments, stakeholders in the cocoa sector must adopt robust strategies to navigate the changing landscape. Key considerations include:

- Supply Chain Resilience: Strengthening relationships with suppliers and diversifying sourcing options can mitigate risks associated with over-reliance on a single region.

- Market Intelligence: Continuous monitoring of market trends and export data from key producing countries will facilitate informed decision-making.

- Financial Hedging: Utilizing hedging strategies can help manage price volatility, protecting profit margins during periods of uncertainty.

To Wrap It Up

the cocoa market is experiencing notable fluctuations as concerns over a potential decline in Ivorian exports escalate.With Ivory Coast being a key player in global cocoa production, any disruptions in supply chains could have significant implications for both producers and consumers alike. As traders and analysts closely monitor the situation, the impact of these developments on cocoa prices remains to be seen. The industry’s resilience will be tested in the coming weeks, and stakeholders must navigate this evolving landscape with caution.For now, the spotlight remains firmly on Ivory Coast, where the future of cocoa supply may hinge on a combination of weather patterns, political stability, and global demand trends.