Introduction:

As concerns over escalating trade tensions continue to weigh on market sentiment, both the S&P/TSX Composite Index and U.S. stocks are experiencing notable declines.Analysts are closely monitoring the ramifications of these trade disputes, notably as they pertain to key sectors of the North American economy. This article delves into the latest market trends and implications for investors, offering insights from financial experts on what the sustained slide in stock prices could mean for the future.With the complexities of international trade creating uncertainty,stakeholders are left grappling with the potential impact on growth and stability across the borders.

Impact of North American Trade Tensions on S&P/TSX composite Index

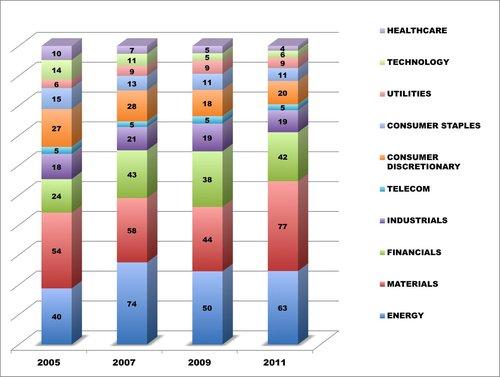

The ongoing trade tensions between North America have put significant pressure on the S&P/TSX Composite Index, reflecting the interconnectedness of global markets and the vulnerability of local economies to external shocks. As tariffs and trade barriers fluctuate, investor confidence wavers, leading to increased volatility. Key sectors impacted include:

- Energy: Canadian oil and gas companies struggle with export limitations.

- Materials: The mining sector faces heightened scrutiny over commodity pricing and demand.

- Consumer Discretionary: Businesses dependent on cross-border sales report declining revenues.

Considering these challenges, market analysts suggest that greater clarity in trade negotiations could help stabilize the index. However, until there is a resolution, companies are likely to adjust their forecasts and capital expenditures to navigate the uncertainty. The following table highlights the recent performance trends of the S&P/TSX Composite Index in relation to trade-related events:

| Date | Trade Event | Index Response (%) |

|---|---|---|

| Q1 2023 | Announcement of New Tariffs | -2.5 |

| April 2023 | Trade Negotiation Resumption | +1.8 |

| August 2023 | Failing to Reach Agreement | -4.1 |

U.S. Stock Market Reactions to Ongoing Trade Disputes

The ongoing trade disputes between the United States and its North American neighbors have created a ripple effect across financial markets.Investors are displaying heightened caution as tariffs fluctuate and negotiations stall, fueling uncertainties about future economic stability. With each announcement, the S&P and TSX composite indices reflect the increased volatility, characterized by a noticeable decline in stock prices.Key sectors such as technology, manufacturing, and agriculture are feeling the pressure, with many companies reporting diminished profit forecasts as global supply chains become more expensive and complex.

Market analysts have identified several factors contributing to the downward trends, including:

- Investor Sentiment: The fear of further economic ramifications deters investment.

- Corporate Earnings: Many sector leaders are revising their earnings outlooks,citing increased costs due to tariffs.

- Policy Changes: Uncertainty around government policies and the prospect of future tariffs create additional unease.

As trade discussions remain at an impasse, the potential for short-term resolution seems bleak. Observers are closely monitoring key economic indicators that could signal a shift in market dynamics. The following table summarizes stock performance in key sectors affected by trade tensions:

| Sector | Recent Decline (%) |

|---|---|

| Technology | -5.4 |

| Manufacturing | -4.2 |

| Agriculture | -3.5 |

Sector Performance Insights Amidst Trade Uncertainty

As trade uncertainties loom large over North America,sectors across the stock markets are responding with notable volatility. The S&P/TSX composite and U.S. stocks have both experienced declines, spurred by concerns surrounding tariffs and trade negotiations. industries heavily reliant on exports, such as manufacturing, technology, and agriculture, have taken significant hits, reflecting investor apprehensions about potential disruptions in supply chains and market access. These dynamics create an environment in which businesses are forced to reevaluate their strategies for navigating increasingly protectionist policies.

In analyzing the specific sector performances, it’s evident that some areas remain more resilient than others. The following highlights the impacted sectors and their responses to the current climate:

- Energy: A modest rebound is observed, driven by fluctuating oil prices and renewed demand forecasts.

- Consumer Discretionary: Faced with pressure, this sector is witnessing a downturn as consumer sentiment softens amid uncertainty.

- Financials: Banks and financial institutions are grappling with tighter margins and increased regulation concerns, resulting in a cautious outlook.

To further illustrate the ongoing sector dynamics, the table below summarizes recent performance metrics:

| Sector | Performance (%) Last Month |

|---|---|

| energy | +3.1 |

| consumer Discretionary | -2.8 |

| Financials | -1.5 |

the response to trade tensions is unveiling complex interactions among sectors, as market players adjust to the ever-evolving economic landscape.As uncertainty persists, investors and analysts alike will need to remain vigilant to navigate this challenging terrain.

Investment Strategies to Navigate current Market Volatility

As the S&P/TSX composite and U.S. stocks face continued downward pressure amid escalating trade tensions, investors must adapt their strategies to protect their portfolios. Emphasizing diversification across various sectors can mitigate risks associated with market volatility. Those looking to hedge against potential downturns might consider assets such as precious metals or bonds, which often perform well during economic uncertainties. Additionally, liquid assets such as cash or cash equivalents allow for fast reallocation when opportunities arise.

another effective approach is adopting a long-term perspective while capitalizing on short-term fluctuations. A well-defined investment thesis can definitely help discerning investors identify undervalued stocks that may rebound once volatility decreases. Here are some strategies to consider during these turbulent times:

- Invest in defensive stocks: Identify companies in essential sectors such as utilities or consumer staples that typically withstand downturns.

- utilize dollar-cost averaging: Consistently invest a fixed amount over time to take advantage of market dips without timing the market.

- Focus on quality: Look for strong fundamentals, including robust earnings growth and low debt-to-equity ratios.

Future Outlook for North American Markets in a Shifting Trade Landscape

The future of North American markets appears increasingly intertwined with geopolitical considerations, as shifting trade dynamics weigh heavily on investor confidence. In the wake of ongoing tensions, analysts suggest that businesses may need to adapt quickly to an evolving landscape characterized by protectionist policies and fluctuating tariffs. Key factors influencing this outlook include:

- Supply Chain Adjustments: Companies are reassessing their supply chain strategies to mitigate risks associated with tariffs and trade barriers.

- Market diversification: Firms may seek to diversify their markets to lessen dependency on North American trade, exploring opportunities in emerging economies.

- Regulatory Changes: Any forthcoming legislative shifts in trade agreements could present both challenges and opportunities for sectors heavily reliant on cross-border trade.

Furthermore, consumer sentiment could shift dramatically in response to these trade dynamics. As uncertainty persists, the likelihood of reduced consumer spending looms, which could further amplify market volatility. A look at recent projections indicates that sectors most vulnerable to trade fluctuations, such as manufacturing and agriculture, may face prolonged challenges. A simplified market performance overview is shown in the table below:

| Sector | projected Impact |

|---|---|

| Manufacturing | High risk due to tariffs |

| Agriculture | Potentially negative due to export barriers |

| Technology | Classified as resilient amid shifts |

Closing Remarks

the continuing slide of the S&P/TSX Composite and U.S. stocks underscores the profound impact of rising trade tensions across North America.Investors are grappling with uncertainty as mixed signals from policy-makers and shifting market dynamics influence economic sentiment. As we navigate these turbulent waters, it remains crucial for stakeholders to stay informed and vigilant. The interplay between trade agreements, market performance, and economic stability will undoubtedly shape the financial landscape in the coming weeks. As developments unfold, keeping a close eye on these factors will be essential for making informed decisions in this fast-evolving environment.