In a critically important move aimed at bolstering tax compliance and enhancing revenue collection, authorities have sealed 374 properties belonging to tax defaulters, as reported by The Times of India. This decisive action underscores the government’s commitment to tackling tax evasion and enforcing fiscal responsibility among its citizens. With the backdrop of mounting fiscal pressures, the sealing operation not only targets those who have neglected their tax obligations but also serves as a stern warning to others who might consider evading their responsibilities. The move is part of a broader strategy to ensure accountability and promote a culture of compliance in the nation’s economic landscape. In this article, we delve into the implications of this operation, the profiles of the defaulters, and the broader context of tax collection efforts in the country.

impact of Sealing Tax Defaulter Properties on Local Economy

The recent sealing of 374 properties belonging to tax defaulters has brought to the forefront a significant concern regarding its implications for the local economy. The immediate effect of such actions often creates a ripple effect through various sectors, affecting not just the defaulters but also their tenants, employees, and local businesses. With properties sealed, the flow of income for landlords halts, which can lead to increased vacancies and subsequently, a downtrend in real estate value. additionally, those who rely on these businesses for employment face uncertainty, as local job markets tremble under the weight of reduced economic activity.

On a broader level, the sealing of these properties may also diminish the local government’s revenue, as fewer engaged businesses mean less in terms of local taxes. Sustained efforts to recover unpaid dues may lead to a temporary tightening of the economy.The fallout can lead to a reduced consumer base, which further impacts small businesses dependent on local spending. To illustrate the potential economic drain, consider the following table outlining projected losses across several community sectors:

| Sector | Estimated Economic Impact |

|---|---|

| Real Estate | -15% property value |

| Retail | -20% sales |

| Employment | -200 jobs affected |

| Local Government | -30% tax revenue |

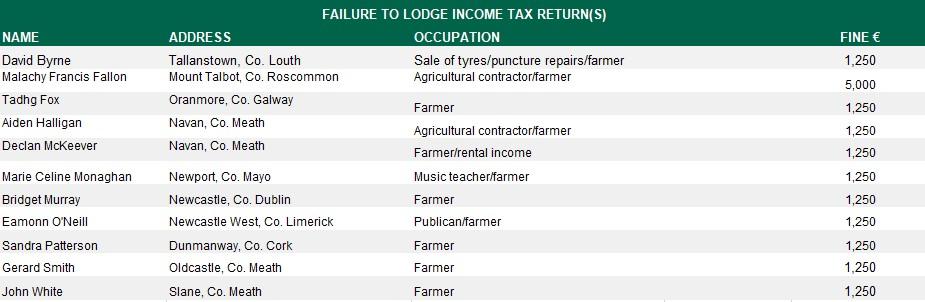

Legal Proceedings and the Pathway to Compliance for Defaulters

Recent actions taken against tax defaulters have highlighted the rigorous measures being implemented. A total of 374 properties belonging to individuals who failed to meet their tax obligations have been sealed. this step not only serves as a form of punishment but also stresses the significance of complying with tax regulations. tax authorities are intensifying their efforts to ensure that all citizens contribute their fair share, and the sealing of properties is just a component of a broader strategy aimed at achieving compliance and curbing tax evasion.

Defaulters now face a structured legal process aimed at rectifying their tax status. The pathway to compliance typically includes the following steps:

- Assessment of Outstanding Taxes: Defaulters receive notifications detailing the amount owed.

- Opportunity for Appeal: Individuals are granted a limited timeframe to contest the assessment if they believe it to be erroneous.

- Negotiation and Settlement: Manny are encouraged to negotiate payment plans or settlements to clear their dues.

- Legal Enforcement: For persistent defaulters, property sealing is enacted as a final measure to compel compliance.

The table below summarizes the potential penalties and resolutions available for tax defaulters:

| Type of Non-compliance | Possible Penalties | Resolution Options |

|---|---|---|

| Failure to Pay | Property Sealing, Fines | payment Plan, Offer in Compromise |

| Providing False Facts | Legal Action, Hefty Fines | Amendments, Restitution |

| Repeated Defaulting | Criminal Charges | Voluntary Disclosure, Negotiated Settlement |

Government Strategies for Addressing Tax Evasion in Real Estate

In recent years, governments worldwide have intensified their efforts to combat tax evasion, especially within the real estate sector. A multifaceted approach has emerged, focusing on increasing clarity, enhancing regulatory frameworks, and deploying advanced technology.key strategies include:

- Enhanced data sharing: Governments are collaborating with financial institutions and real estate companies to facilitate the exchange of information, ensuring that all property transactions are properly reported.

- Strengthening regulations: Legislation aimed at closing loopholes and tightening compliance requirements is being prioritized.This includes mandatory disclosure of beneficial ownership for property acquisitions.

- Use of technology: the adoption of data analytics and artificial intelligence enables tax authorities to identify suspicious patterns and flag potential defaulters in real time.

Additionally, governments are increasingly focusing on punitive measures to deter tax evasion. The sealing of properties owned by tax defaulters,as highlighted in recent news,serves as a stark reminder of the consequences of non-compliance. These punitive actions are supported by:

- Increased audits: Random and targeted audits are being conducted to scrutinize tax filings and assess property valuations.

- Public awareness campaigns: Educating citizens about tax responsibilities and the importance of compliance fosters a culture of accountability.

- International cooperation: Governments are working together on cross-border tax enforcement efforts to tackle evasion that spans multiple jurisdictions.

Community Reactions and Implications for Future Tax Policies

The recent sealing of 374 properties belonging to tax defaulters has sparked a wave of reactions throughout the community, reflecting a growing frustration with tax evasion and its consequences. Many local residents view this action as a necessary step towards greater accountability and fair revenue collection. apart from supporting government initiatives, community members have expressed concern about the broader implications of tax defaulters on public services and infrastructure funding. Some key reactions include:

- Support for Enforcement: Numerous citizens have voiced gratitude for the government’s crackdown on tax evasion, emphasizing the need to hold defaulters accountable.

- Concerns Over Impact: Property owners and tenants alike worry about the potential fallout from sealing properties,which could lead to housing shortages and affect local businesses.

- discussion of Tax Policies: This situation has initiated debates on how tax policies can be restructured to minimize evasion while ensuring fair treatment of responsible taxpayers.

As this situation unfolds, it might prompt policymakers to revisit and revise tax regulations with community inputs to ensure effective revenue generation and compliance. Potential strategies to consider include implementing more obvious tax systems, enhancing digital payment options, and introducing incentive programs for timely payments. The focus on a collaborative approach could lead to the development of a more equitable taxation framework. A quick overview of potential strategies is illustrated in the table below:

| Strategy | Description |

|---|---|

| Transparency | Establish clear tax policies accessible to all taxpayers. |

| digital Payments | Facilitate easier payment processes to enhance compliance. |

| Incentives | Reward timely payments with discounts or deductions. |

Recommendations for Strengthening Tax Collection mechanisms

In light of the recent sealing of 374 properties belonging to tax defaulters,it is indeed imperative to address ways to enhance the efficacy of tax collection systems. One of the primary strategies is to invest in advanced technology for better monitoring and data analysis. By leveraging big data and analytics, tax authorities can identify patterns of non-compliance, thus allowing for preemptive measures rather than reactive ones. Additionally, implementing a more robust public awareness campaign can help educate taxpayers about their obligations and the consequences of defaulting on taxes.

Furthermore, fostering collaboration between various governmental agencies can improve the collection process. Establishing a extensive database that integrates tax information with real estate and financial records will enable cross-referencing and timely interventions. Key recommendations include:

- Regular audits and follow-ups on high-risk individuals and entities.

- Incentives for compliance, such as discounts for early payments or reduced penalties for voluntary disclosures.

- Training programs for tax officials to enhance their skills in negotiation and conflict resolution.

The Role of Technology in Tracking and Managing Tax Compliance

In an era where tax compliance is critical for economic stability, the integration of technology has emerged as a game-changer in monitoring and managing tax obligations. Advanced data analytics and artificial intelligence are now being employed by tax authorities to identify patterns of tax evasion and assess risks adequately. Real-time data processing enables the analysis of transactions across various sectors, making it easier to pinpoint discrepancies in reporting. Furthermore, the development of sophisticated software solutions allows tax bodies to streamline processes, reducing the administrative burden that comes with customary methods of tax collection and enforcement.

The implementation of digital tracking systems has also played a significant role in enhancing transparency within the tax ecosystem. By leveraging technologies such as blockchain, governments can create immutable records of transactions, ensuring that both taxpayers and authorities operate on the same information spectrum. This has several benefits, including:

- Increased accountability: Organizations are held responsible for their financial dealings.

- Faster audits: Automated tools can expedite the audit process,allowing for swifter resolutions.

- Improved taxpayer services: Enhanced user interfaces for tax filing platforms lead to better compliance rates.

technological innovations are redefining how tax compliance is tracked and managed, ultimately contributing to a more equitable and efficient tax system.

The Way Forward

the sealing of 374 properties belonging to tax defaulters underscores the government’s firm stance on addressing tax evasion and ensuring compliance with fiscal responsibilities.This significant action not only aims to recover the outstanding dues but also serves as a deterrent to others who may consider evading their tax obligations. The authorities are likely to continue their crackdown on non-compliance,sending a clear message that tax evasion will not be tolerated. As the situation develops, it remains crucial for taxpayers to remain informed and adhere to their responsibilities, contributing to the overall economic health of the nation. The implications of this move will be closely watched, as it reflects broader efforts to enhance transparency and accountability within the tax system.