In a significant development for global markets, Asian stock indices are poised for an upward trajectory, buoyed by the announcement of new economic measures by the Chinese goverment. As investors digest the implications of these initiatives, which aim to stimulate growth in the world’s second-largest economy, sentiment across Asia appears optimistic. this article delves into the specifics of the Chinese measures, their potential impact on the broader regional markets, and the factors contributing to this rally, as we wrap up the latest market trends and insights from Yahoo Finance.

Asia Stock Markets Respond Positively to New chinese economic Measures

Asian stock markets are experiencing a surge following the introduction of new economic measures by the Chinese government aimed at stabilizing the economy. Analysts have noted a noticeable uptick in investor confidence as these policies, which focus on boosting domestic consumption and providing liquidity to struggling sectors, begin to take effect. The renewed optimism has been reflected across major indexes, driving a two-day rally that has led to significant gains in shares of key sectors, including technology, consumer goods, and real estate.

Market participants have been especially encouraged by the government’s commitment to enhancing foreign investment and supporting small and medium-sized enterprises (SMEs). This is expected to lay the groundwork for sustainable growth in the coming quarters. Key developments include:

- Interest rate cuts aimed at stimulating lending.

- tax breaks for businesses to increase spending.

- Infrastructure investments designed to boost economic activity.

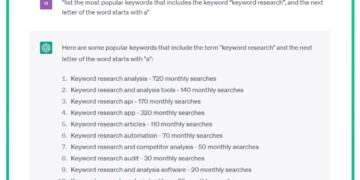

In addition, several brokerage firms have upgraded their projections for Chinese stocks, predicting robust earnings growth as the measures take hold. The following table illustrates the performance of selected Asian markets following the announcement:

| Market | index Change |

|---|---|

| Shanghai Composite | +3.5% |

| Nikkei 225 | +2.1% |

| Hang Seng Index | +4.0% |

| KOSPI | +2.7% |

Investors Anticipate Sustained Growth Amid Policy Support from Beijing

As the markets respond positively to recent measures from Beijing, investors are increasingly optimistic about the prospects for sustained growth in the region. The government’s commitment to supporting economic recovery is evident in a series of financial policies aimed at bolstering both consumer spending and business investment.Key initiatives being closely monitored include:

- Increased fiscal spending: Enhanced infrastructure investments to stimulate job creation and economic activity.

- Interest rate adjustments: Potential cuts to borrowing costs aimed at encouraging lending.

- Consumer incentives: Programs designed to boost household consumption, particularly in key sectors like automotive and technology.

Moreover, analysts believe that as confidence returns to the market, we can expect a ripple effect across various sectors. Companies engaged in technology, renewable energy, and consumer goods are particularly poised to benefit. A preliminary assessment of market conditions suggests an upward trajectory:

| Sector | Projected Growth Rate (%) |

|---|---|

| Technology | 10% |

| Renewable Energy | 12% |

| consumer Goods | 8% |

The fusion of these supportive measures alongside robust corporate earnings forecasts positions Asian markets as a focal point for investor activity, reinforcing a bullish outlook through the remainder of the year. As stakeholders navigate this evolving landscape, the sentiment remains steadfast that policy support will be a fundamental driver of growth.

Sector Highlights: how New measures Are Influencing Technology and Real Estate

Recent measures announced by the Chinese government are starting to have a profound impact on key sectors, particularly technology and real estate. Investors are closely monitoring the government’s commitment to fostering an environment conducive to growth, which includes initiatives aimed at enhancing innovation and encouraging international partnerships.The liberalization of policies is expected to boost the confidence of global investors, consequently spurring a wave of funding and interest in tech start-ups and established firms alike. This shift may result in accelerated advancements in areas such as artificial intelligence, cloud computing, and biotechnology, further solidifying China’s role as a global tech leader.

In the real estate sector,the new measures aim to alleviate the ongoing liquidity crisis by introducing more favorable financing options for development projects and easing restrictions on property purchases. These changes are seen as a lifeline for struggling developers and may lead to a stabilization of property values, which in turn can rejuvenate consumer confidence. As a result, analysts anticipate a gradual recovery of the housing market, fostering a more vibrant economic environment. Key impacts include:

- Increased investment in smart cities – Leveraging technology to enhance urban living.

- Regulatory changes – Simplifying approval processes for new developments.

- Foreign investments – Encouraging global investors to partake in local real estate opportunities.

Expert Insights: Strategic Investment Approaches in a Dynamic Asian Market

As Asian markets respond to the newly announced measures from China aimed at bolstering economic growth, investors are strategically reevaluating their positions. With optimism rising, market analysts highlight several key factors driving this rally. The influx of liquidity and targeted stimulus measures are crucial in energizing sectors such as technology and real estate, which had previously shown signs of stagnation. Investors should consider:

- sector Diversification: Moving beyond customary equity investments to encompass emerging trends in green tech and digital infrastructure.

- Geographical Expansion: Exploring opportunities in less conventional markets within Southeast Asia as growth rates accelerate.

- Asset Allocation: Balancing traditional assets with commodities or cryptocurrencies, given the rising inflation concerns.

Furthermore, it is essential to maintain a keen eye on geopolitical developments and trade dynamics that could influence market sentiment. Analysts speculate that sectors directly benefiting from government policies are poised to outperform, making sector rotation a sound strategy. A growing emphasis on sustainable investments is also impacting portfolio management decisions. For clarity, the following table outlines sectors to watch closely:

| Sector | Potential Growth Drivers | Investment considerations |

|---|---|---|

| Technology | Government support, innovation | High volatility, long-term gains |

| Real Estate | Urbanization, policy easing | Yield stability, cyclical risks |

| Green Energy | Regulatory incentives, consumer trends | High impact, initial costs |

Global Implications: What Asia’s rally Means for International Investors

The recent stock rally in Asia, fueled by innovative measures from China, is poised to create significant ripples in the global investment landscape. As international investors closely monitor this shift, several implications are becoming increasingly evident. Among the notable effects are:

- Increased capital flow to emerging markets: Investors are likely to redirect funds towards Asian stocks, anticipating growth opportunities that could yield high returns.

- Strengthening of regional partnerships: enhanced economic ties within Asia may lead other countries to explore strategic alliances, impacting trade dynamics.

- Investor confidence in recovery: Positive sentiment in major Asian economies can spill over into developed markets, potentially boosting stock indices worldwide.

Additionally, the implications for sectors such as technology, manufacturing, and consumer goods are particularly noteworthy.The adjustments in Chinese policies aimed at stimulating domestic consumption are expected to catalyze growth in:

| Sector | Potential Impact |

|---|---|

| Technology | Increased investment in innovation and growth, attracting global tech firms. |

| Manufacturing | Boost in production capacity, making Asia a more competitive player in global supply chains. |

| Consumer Goods | Surge in demand, prompting international brands to expand operations into Asia. |

Market Watch: Key Indicators to Monitor in the Coming Weeks

As investors assess the implications of China’s recent economic stimulus measures, several key indicators will play a pivotal role in shaping market sentiment in the weeks ahead. Keep an eye on GDP growth rates, which will provide insights into the effectiveness of these measures as they aim to bolster economic recovery. Additionally, manufacturing and service sector PMIs will be essential for gauging economic activity. Watch for trends in consumer confidence indices, as increased consumer spending could signal a positive shift in the economic landscape.

Another crucial aspect to monitor is the foreign exchange market, particularly fluctuations in the Chinese yuan. these moves can significantly influence regional currencies and trade balances. Additionally, updates on inflation rates will be of utmost importance; any spikes could force central banks to reconsider their monetary policies.Lastly, investor sentiment on global commodities, especially oil and metals, will be instrumental in determining how markets react to geopolitical tensions and supply chain disruptions.

In Summary

the recent policy measures introduced by the Chinese government signal a pivotal moment for Asia’s financial markets, potentially igniting a stock rally that could reverberate across the region.Analysts remain cautious yet optimistic, watching how these measures will translate into tangible economic growth and investor confidence. As Asian markets brace for the upcoming trading sessions, the interplay between government policy and market dynamics will be crucial in shaping the outlook for investors. With signs of resilience and renewed commitment to reform, there is a sense of anticipation in the air, making it a critical time for stakeholders in the Asia-Pacific markets. As we continue to monitor these developments, the global community will be keenly observing how China’s strategies impact broader economic trends and investor behaviour across the region. Stay tuned for further updates as these unfolding events could redefine the trajectory of both Asian and global markets in the weeks to come.