In an era marked by escalating trade tensions and economic uncertainty, the Middle East stands at a critical crossroads, influenced by the intertwined fates of oil, currency, and debt. As global powers navigate an increasingly fractious landscape shaped by protectionist policies and tariff warfare, the region’s economic stability faces new challenges and opportunities. In this article, we explore the complex interplay between oil wealth, the dominance of the dollar, and the burden of debt that defines the economic landscape of the Middle East.We examine how these factors not onyl impact local economies but also position the region within the larger narrative of the global trade war,raising questions about its vulnerability and resilience in the face of shifting geopolitical tides. Delving into insights from economists, policymakers, and market analysts, we seek to uncover how safe the middle East truly is in the context of an uncertain global economic future.

Impact of Oil Prices on Regional Economies

The fluctuating nature of oil prices has a profound impact on regional economies, particularly in the Middle East, where many nations are heavily reliant on oil revenues. High oil prices often lead to increased government spending due to buoyant revenues, which can result in improved infrastructure and social services. Though, when prices fall, as they have periodically in recent years, governments face budget shortfalls, leading to austerity measures that can exacerbate social tensions. Key implications of oil price volatility include:

- Fiscal Stability: Countries with diversified economies may weather oil price declines better than those heavily dependent on oil.

- Investment Climate: Low oil prices can deter foreign investment, while high prices can attract capital for infrastructure projects.

- Social Unrest: Increased unemployment and decreased public services in times of low oil prices can lead to civil discontent.

To better illustrate the impact of oil price changes on different regional economies, the following table summarizes the potential economic scenarios for selected Middle Eastern countries based on varying oil price levels:

| Country | High Oil Price Scenario | Low Oil Price Scenario |

|---|---|---|

| Saudi Arabia | Increased investment in Vision 2030 projects | Belt-tightening measures; potential budget deficit |

| iran | Fuel subsidies for citizens; improved economic outlook | Rising inflation; impact of sanctions worsens |

| UAE | Expansion in tourism and real estate sectors | Reduced tourism revenues; slowed economic growth |

The Role of the US Dollar in Middle Eastern Trade Dynamics

The US dollar remains a cornerstone of trade in the Middle East, primarily due to its dominance in the global oil market. Most oil transactions are conducted in dollars, which has enabled the currency to hold a significant position in international trade. This reliance creates a complex web of economic interdependencies, influencing regional relationships and trade dynamics. Key factors contributing to the dollar’s role in the Middle Eastern trade landscape include:

- Petrodollars: Oil-exporting countries reinvest their dollar earnings in US assets, further entrenching the dollar’s stature.

- Stability and Trust: The dollar is perceived as a stable currency amid global economic fluctuations, making it a preferred medium for trade.

- Political Alliances: Dollar dominance often reflects geopolitical alliances, as many Middle eastern nations maintain close ties to the US.

However, the increasing discourse surrounding currency diversification poses a potential challenge to the dollar’s supremacy. Regional nations are exploring alternatives such as digital currencies and moving towards trade agreements in local currencies to reduce reliance on the dollar. Such shifts may not only reshape trade patterns but also impact foreign exchange reserves and economic strategies. Below is a brief overview of current trends in currency use among select Middle Eastern countries:

| Country | Current currency in Trade | Percentage of trade in USD |

|---|---|---|

| Saudi Arabia | Saudi Riyal | 90% |

| UAE | Dirham | 85% |

| Iran | Iranian Rial | 60% |

Debt Levels and Economic Resilience in Oil-Dependent Nations

The economic landscape of oil-dependent nations is intricately intertwined with their debt levels, which can considerably influence their resilience to external shocks. In a world where oil prices are volatile, many Middle Eastern economies rely heavily on oil revenues to sustain government spending and public services. High debt levels can exacerbate vulnerabilities, making these countries less adaptable to fluctuations in global oil markets. Additionally, heavy borrowing can stifle economic growth, especially when a significant portion of revenues are allocated to debt servicing rather than investment in infrastructure or diversification of the economy.

To better understand this correlation, it’s essential to analyze the debt-to-GDP ratios and fiscal health of these nations. Below is a simplified portrayal of selected oil-dependent countries, showcasing their debt levels against other critical economic indicators:

| Country | Debt-to-GDP Ratio (%) | Oil Revenue Dependency (%) |

|---|---|---|

| Saudi Arabia | 34 | 90 |

| Iraq | 62 | 95 |

| Kuwait | 16 | 86 |

| UAE | 26 | 30 |

As illustrated, while some nations like Kuwait maintain a relatively low debt burden, others, such as Iraq, face significant challenges due to higher debt levels and dependence on oil revenues. This precarious balance between debt management and oil price stability underlines the importance of strategic economic reforms and diversification efforts, which could safeguard these nations against global economic disturbances.

Geopolitical Tensions and Their Influence on Trade Relations

The intricacies of global trade have become increasingly entangled with shifting geopolitical landscapes, particularly in the Middle East, where alliances and rivalries can dramatically impact oil markets and, by extension, the global economy. As tensions rise among nations, trade relations frequently enough bear the brunt, leading to potential disruptions in the flow of oil, a critical commodity. Factors such as sanctions, political instability, and military conflicts can not only elevate oil prices but also incite volatility in foreign exchange markets, adversely affecting the stability of currencies tied to commodity trading.

Countries in the region are grappling with this delicate balance as they position themselves strategically to either broker peace or assert power through resource control. Key influencers in this dynamic include:

- The United States: Its foreign policy decisions significantly shape market confidence and investment flows.

- China: As a major importer of oil, its relationships with Middle Eastern countries hold ample weight in trade agreements.

- Regional Powers: Nations like Saudi Arabia and Iran are frequently enough at the centre of tensions that can ripple through global supply chains.

To illustrate the impact of these geopolitical tensions on trade relations, consider the following table that summarizes recent trade developments involving Eastern and Western nations:

| Country | Recent Trade Action | Impact on Oil Prices |

|---|---|---|

| United States | Imposed sanctions on Iran | increased global oil prices |

| China | Signed multi-year oil agreements with Iraq | Stabilized demand in the region |

| Saudi Arabia | Announced production cuts | Supported higher oil prices |

Strategies for Diversification Beyond Oil Revenue

With the volatility of oil markets and the specter of global trade tensions, Middle Eastern economies are compelled to seek innovative . Developing renewable energy sources such as solar and wind is crucial, given the region’s abundant sunlight and wind patterns. Investment in technology and innovation can further spur economic resilience, creating a robust start-up ecosystem that attracts both regional and international investors. Countries like the UAE are already making strides with their commitment to sustainable projects, while others are encouraged to follow suit and harness their unique geographical advantages.

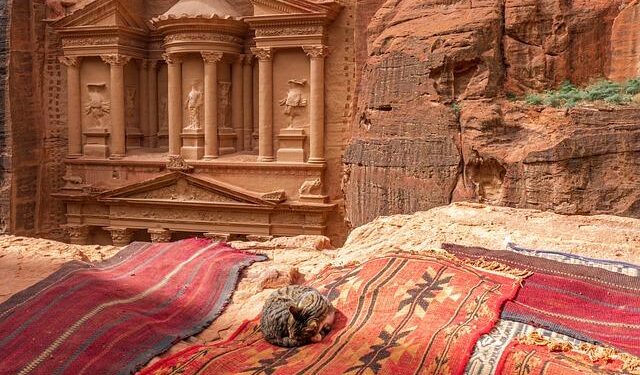

Additionally, forging strategic trade partnerships will be essential for the Middle East. Building alliances with non-oil producing nations can create new markets for diversified products, thereby reducing dependency on oil revenues. Enhancing tourism and hospitality sectors can also yield dividends, especially for nations rich in cultural heritage and natural attractions. To support these initiatives, governments might consider implementing incentive programs for small and medium-sized enterprises (SMEs) to foster innovation and job creation across various sectors. Below is a summary of potential diversification strategies:

| Strategy | Description |

|---|---|

| Renewable Energy | Investing in solar and wind projects to reduce fossil fuel reliance. |

| Technology & Innovation | Cultivating a tech ecosystem to attract global investors and talent. |

| Strategic Trade Partnerships | Creating alliances with non-oil nations for market diversification. |

| Tourism Progress | Enhancing the hospitality sectors to draw international visitors. |

| Support for SMEs | Implementing incentives to promote innovation and job growth. |

Mitigating Risks Amidst a Shifting Global Economy

The Middle East, historically a crucial player in the global economy, faces unique challenges as shifts in trade dynamics unfold. Countries in the region must navigate the complexities of fluctuating oil prices, exchange rates, and geopolitical tensions. In this volatile climate, strategic plans for economic resilience are more vital than ever. Key strategies include:

- Diversification of Economies: Reducing reliance on oil by investing in technology, tourism, and renewable energy.

- Strengthening Regional Trade Agreements: Enhancing trade partnerships among neighboring countries to create a more robust economic buffer against external shocks.

- Fiscal Prudence: Maintaining low debt levels and prudent fiscal policies to withstand potential economic downturns.

Additionally, to further mitigate risks, the Middle East can leverage its substantial foreign currency reserves, largely held in U.S. dollars, to provide a cushion against global economic fluctuations. This can be accomplished by:

- Investing in Strategic Assets: channeling reserves into stable, long-term investments that yield consistent returns.

- Enhancing Financial Openness: Building investor confidence through robust governance and transparency measures.

- Adapting to Technological Changes: Implementing digital solutions that streamline economies and improve efficiency.

| Strategy | Benefit |

|---|---|

| diversification of economies | Reduces vulnerability to oil price shocks |

| Strengthening regional Trade Agreements | Increases economic stability |

| Fiscal Prudence | Prepares for unforeseen economic downturns |

| Investing in Strategic Assets | Secures long-term financial growth |

| enhancing Financial Transparency | Boosts investor trust |

| Adapting to Technological Changes | Improves overall economic efficiency |

The Conclusion

As the global trade war continues to reshape economic landscapes, the Middle East finds itself at a crossroads, influenced significantly by the intertwined dynamics of oil, currencies, and national debt. While the region has historically leveraged its oil wealth to bolster economic stability, current geopolitical tensions and trade disputes present both challenges and opportunities. The complexities of trade relationships, currency dependence, and debt management underscore the delicate balance that Middle Eastern nations must navigate in this evolving scenario.

With the potential of economic repercussions rippling across global markets, the region’s response will not only determine its immediate economic resilience but also its long-term strategic positioning in an increasingly multipolar world. As policymakers and industry leaders look ahead, the importance of adapting to shifting dynamics and fostering robust trade partnerships will be paramount in ensuring sustainable growth. The future remains uncertain, but one thing is clear: the interplay of oil, dollars, and debt will continue to be pivotal in defining the Middle East’s role on the global stage amidst ongoing challenges.