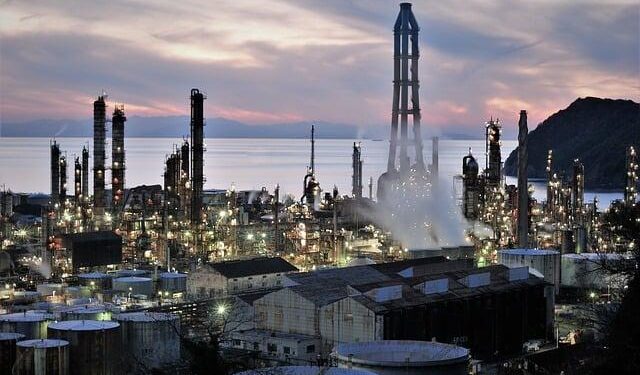

In a notable advancement for Nigeria’s energy sector, the Dangote Refinery has announced plans to suspend fuel sales in the local currency, a move that could impact fuel distribution and pricing across the nation. This decision, reported by Reuters, raises questions about the implications for consumers and the broader economy as the country grapples with ongoing challenges in its oil and gas industry. With Nigeria being one of Africa’s largest producers of crude oil yet facing persistent fuel shortages and economic volatility, the refinery’s announcement marks a pivotal moment for energy stakeholders and consumers alike.As the situation unfolds, it is essential to examine the potential ramifications of this policy shift and the prospects for the country’s energy landscape.

Dangote refinery Announces Suspension of Fuel Sales in Local Currency

Nigeria’s largest oil refinery, owned by billionaire Aliko Dangote, has made headlines with its recent announcement to temporarily halt fuel sales in local currency. This decision is viewed as a significant pivot in the nation’s fuel market, which has long struggled with fluctuating foreign exchange rates and the impact of global oil prices. The refinery has pointed to a variety of challenges that necessitate this suspension, primarily the need to stabilize operations and manage input costs effectively.

According to sources within the company, the suspension will effect numerous retail outlets across the country, leading to concerns among consumers about possible fuel shortages. In light of this development, stakeholders are keenly observing the implications for pricing and accessibility. The oil giant plans to transition to more stable currencies for its sales, which may have various repercussions for the local economy. Key aspects of this situation include:

- Impact on Fuel Prices: Potential increases in cost due to currency fluctuations.

- Consumer Reaction: Possible unrest and dissatisfaction among customers.

- Market Stability: The need for a stable currency to ensure reliable fuel supply.

Implications for Nigeria’s Fuel Market and Economic Climate

The decision by Dangote Refinery to cease fuel sales in local currency could have significant ramifications for Nigeria’s fuel market and overall economic habitat. given that Dangote is one of the largest players in the sector, its shift to dollar-based transactions may trigger a ripple effect, compelling other fuel suppliers to follow suit. This transition may lead to an increase in fuel prices in local markets, as businesses now grapple with fluctuating exchange rates and potentially inflated costs associated with dollarization. Additionally, this move might exacerbate existing inflationary pressures, as transportation and goods prices are closely tied to fuel costs.

Moreover, the suspension of fuel sales in naira may reflect broader challenges within Nigeria’s economy, particularly regarding currency stability and foreign exchange reserves. As an inevitable result, the implications for consumers could be profound, with many facing increased hardship as fuel becomes more expensive. Businesses might similarly struggle with elevated operational costs, which could, in turn, lead to job losses and reduced economic activity. The government’s response to these developments will be crucial in determining whether Nigeria can maintain a stable and competitive fuel market amid these challenging circumstances.

Understanding the Reasons Behind the Shift to Foreign Currency Transactions

The recent decision by Dangote refinery to suspend fuel sales in local currency is indicative of a broader trend observed in various economies worldwide.This shift to foreign currency transactions can be primarily attributed to currency instability and inflationary pressures, which undermine the value of local currencies. For businesses operating in volatile economic environments, such as Nigeria, relying on foreign currency often provides a sense of security and mitigates the risks associated with fluctuating exchange rates. Additionally,foreign transactions can streamline operations,enabling companies to engage in international trade with greater ease and predictability.

another major factor contributing to this transition is the increased demand for foreign goods and services. As consumers grow more accustomed to international products, local businesses may find it necessary to align their pricing strategies with global standards. This not only helps in maintaining competitiveness but also facilitates better access to international markets. Furthermore, the reliance on foreign currency can enhance financial clarity and accountability within organizations, as it aligns reporting metrics with those of global buisness practices. The ongoing shift reflects an adaptive response to the economic landscape, necessitating a deeper understanding of currency dynamics and trade relations.

Impact on Consumers: What the Change Means for Fuel Prices

The recent announcement from Dangote Refinery to suspend fuel sales in local currency has sent ripples through the Nigerian economy. For consumers, this change could lead to heightened uncertainty around fuel prices, primarily due to the increasing reliance on foreign currency for transactions. Inflationary pressures may worsen, affecting not just fuel costs but also the prices of goods and services that depend on transportation. As fluctuations in exchange rates become more pronounced, consumers might face a new reality where fuel prices are subject to drastic changes based on global currency markets.

Moreover, the potential for increased fuel prices raises concerns about transportation costs, particularly for sectors heavily reliant on fuel, such as logistics and agriculture. This impact could trickle down to the average consumer through increased prices for daily necessities. The following factors will be critical to monitor in the coming months:

- Global Oil Prices: Changes in international oil prices can greatly influence local fuel prices.

- Exchange Rates: Fluctuations in currency values will directly affect fuel costs.

- Supply Chain Dynamics: Any disruptions in fuel availability may lead to short-term price spikes.

as consumers brace for possible higher fuel costs, it remains essential to track these developments closely, considering the broader economic implications that will emerge from this significant policy shift.

Recommended Strategies for Stakeholders in the Energy Sector

In light of the recent announcement by Dangote refinery regarding the suspension of fuel sales in local currency, stakeholders in the energy sector must reassess their strategies to navigate these market dynamics effectively. It’s crucial for investors and operators to focus on securing flexible financing structures that accommodate foreign currency fluctuations. Collaborating with financial institutions to establish hedging mechanisms can mitigate risks associated with volatile exchange rates, aiding in the stabilization of operations. additionally, stakeholder engagement is essential; fostering transparent communication with local communities and government entities can enhance trust, ultimately supporting smoother operations and regulatory compliance.

Adapting to these challenges also involves diversifying supply chains and considering alternative currency transactions. Stakeholders should explore partnerships with international suppliers who are willing to transact in stable currencies, which can buffer against local currency depreciation. Investment in technology that enhances operational efficiency can reduce costs over time,making businesses more resilient in a shifting economic landscape. Moreover, leveraging partnerships with renewable energy firms may present opportunities to align with global shifts towards sustainable practices, thus enhancing long-term competitiveness.

The Future of Nigeria’s Oil Industry amid Currency Challenges

The decision by Dangote refinery to suspend fuel sales in local currency highlights the profound impacts that currency fluctuations can have on Nigeria’s oil and energy sector. This development underscores a growing trend among businesses in the region that are increasingly wary of relying on the naira due to its volatility. Companies are exploring alternatives,such as trading in more stable currencies,to safeguard against inflation and ensure operational viability. The implications of this policy shift could lead to significant repercussions for both consumers and the broader economy, potentially driving fuel prices higher and destabilizing an already delicate market.

Considering these challenges, the future landscape of Nigeria’s oil industry could be shaped by several key factors:

- Foreign Investment: As local businesses pivot away from the naira, foreign investors might be drawn to the potential for more stable transactions and profit repatriation.

- Regulatory Changes: Lawmakers may need to adapt policies to foster a more conducive environment for trade, possibly considering reforms that promote currency stability.

- Technological Advances: Investment in technology could enable companies to optimize operations, reducing costs and mitigating the impacts of currency instability.

To gain a clearer understanding of the ramifications of these shifts, examining trends in the market may prove insightful:

| Factor | Impact |

|---|---|

| Currency Volatility | Increased operational costs for businesses |

| fuel Prices | Potential rise in costs for consumers |

| Investment Climate | Shifts towards non-naira transactions |

Concluding Remarks

the decision by Dangote Refinery to suspend fuel sales in local currency underscores the ongoing challenges facing Nigeria’s economy, particularly amidst fluctuating currency exchange rates and inflationary pressures.As the country grapples with these economic hurdles, the implications of this move could resonate through the fuel market and beyond, impacting consumers and businesses alike. Stakeholders will be closely monitoring how this development unfolds and the potential responses from the Nigerian government and other market players. With the future of fuel pricing and sales strategies now in question, it remains to be seen how this pivotal shift will influence Nigeria’s broader economic landscape.