In a dramatic shift in the global economic landscape, the Japanese yen has experienced a notable resurgence, bringing a wave of challenges to Japan Inc., once buoyed by a weaker currency. As businesses across the nation grapple with the implications of this currency reversal, many companies that thrived in an era of favorable exchange rates are now recalibrating their strategies to adapt to the new reality. This article delves into the reasons behind the yen’s recent strengthening, examines its impact on the Japanese economy, and explores how firms are responding to a changing financial environment that threatens to ground their previously soaring ambitions. With the stakes higher than ever, Japan Inc. faces a critical juncture that could redefine its competitive landscape on the global stage.

Resurgent Yen Signals Shift in Japan’s Export Landscape

The recent appreciation of the yen has fundamentally altered the dynamics for Japanese manufacturers, compelling them to recalibrate their strategies amid intense global competition.A stronger currency means that Japanese goods are becoming relatively more expensive for overseas buyers, which risks dampening demand for exports that have been a cornerstone of the nation’s economy. major sectors,including automotive and electronics,are navigating this new terrain cautiously as they balance pricing pressures with maintaining market share. Analysts are now- reassessing profit forecasts,predicting tighter margins for companies heavily reliant on foreign sales.

| Sector | Impact of Yen Strength |

|---|---|

| Automotive | – Increased production costsn- Price adjustments needed |

| Electronics | – Decline in export volumen- Competitiveness affected |

| Textiles | – Costlier raw materialsn- Shrinking profit margins |

Moreover, this currency shift has broader implications for Japan’s economic landscape, possibly stifling growth momentum that was fueled by post-pandemic recovery. Companies are now exploring a range of strategies, including cost optimization and innovation, to cushion the impacts of fluctuating exchange rates. While some firms are turning to localizing supply chains to mitigate risks associated with currency volatility, others are looking to diversify their markets to reduce dependence on customary export regions. This evolving strategy may redefine japan’s industrial future, highlighting the balance required between global ambition and local realities.

Impact of Currency Strength on Japan Inc’s profitability

The recent strengthening of the yen has sparked a notable shift in the financial landscape for many corporations in Japan.as the currency appreciates against the dollar and other major currencies, companies that rely heavily on exports are feeling the strain. Typically, a strong yen means that the prices of Japanese goods become more expensive for foreign buyers, thus diminishing competitiveness in international markets. This erosion of pricing power can lead to diminished revenues for several sectors, particularly automotive and electronics, which have been pillars of Japan’s export-driven economy.

Additionally,the impact on profitability is multifaceted. While importers may benefit from lower costs for raw materials and components, the overall sentiment remains cautious as companies project potential declines in earnings. Key concerns include:

- margin Compression: Companies may find it challenging to maintain profit margins as they adjust prices to remain competitive.

- Forecast Adjustments: Several firms are revising their profit forecasts downward amidst changing foreign exchange conditions.

- Investor sentiment: A stronger yen can lead to market volatility, impacting stock prices and investor confidence.

To illustrate the financial impact, consider the following table reflecting the expected profit adjustments for major sectors in Japan:

| Sector | Profit Change (%) |

|---|---|

| Automotive | -8 |

| Electronics | -5 |

| Textiles | -3 |

| Food & Beverage | -2 |

Strategies for Companies to Navigate a Stronger Yen

As the yen strengthens, japan’s corporations need to adopt innovative approaches to shield themselves from potential losses in exports and revenue. Here are some key strategies:

- Enhancing Operational Efficiency: Companies shoudl focus on streamlining operations to reduce costs. This can be achieved thru investment in automation and technology that optimize production processes.

- diversifying Markets: Expanding into emerging markets can mitigate the impact of a strong yen. By broadening their customer base beyond traditional markets, companies can balance currency fluctuations more effectively.

- Hedging Financial risks: Utilizing financial instruments, such as currency forwards and options, can help protect against adverse currency movements, allowing businesses to stabilize their earnings.

Moreover, companies can also consider adjusting their pricing strategies to remain competitive. This involves:

- Localizing Pricing: Tailoring prices according to local markets can make products more appealing and offset the effects of a stronger yen on international sales.

- Enhancing Value Proposition: By focusing on quality or unique features, businesses can justify their prices in foreign markets, mitigating the impacts of currency valuations.

- Establishing Joint Ventures: Collaborating with local firms in key markets can provide deeper insights and adaptability in pricing strategies,enhancing competitiveness.

| Strategy | Description |

|---|---|

| Enhancing Operational Efficiency | Streamline production to cut costs and improve margins. |

| Diversifying Markets | Expand into emerging markets to insulate from currency fluctuations. |

| Hedging Financial Risks | Use financial instruments to stabilize earnings against currency swings. |

| Localizing Pricing | Adjust prices based on local market conditions to remain competitive. |

Insights into Consumer Behavior Amid Economic Changes

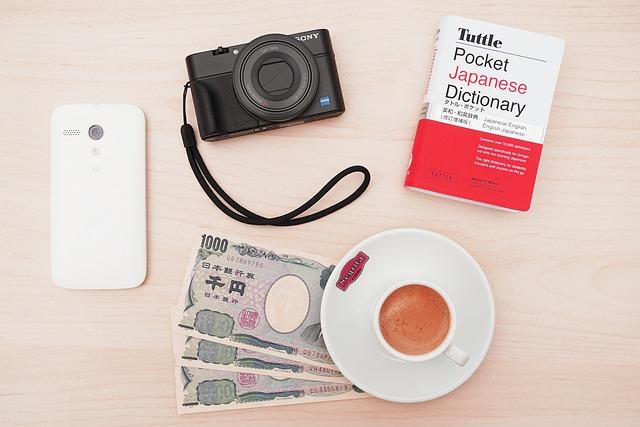

The recent fluctuations in currency valuation following the resurgent yen have notable implications for consumer behavior in Japan. As the cost of imported goods declines, consumers may respond by shifting their purchasing preferences toward international brands, which could impact local businesses. The strengthened yen offers consumers greater purchasing power,potentially leading to an increase in the consumption of luxury goods and travel,as Japanese shoppers take advantage of favorable currency exchange rates. As a result, we could observe a surge in demand for:

- Imported electronics – Consumers may favor foreign tech brands known for their innovation.

- Luxury fashion – High-end international retailers may see increased foot traffic and online sales.

- Travel experiences – An uptick in outbound travel as consumers seek vacations abroad at more affordable prices.

though, this shift in consumer spending could pose challenges for the domestic economy, particularly for businesses that primarily cater to local markets. Japanese firms may need to adapt their strategies to retain customer loyalty and mitigate the effects of changing consumer preferences. An analysis of recent consumer surveys indicates that:

| Consumer Preference | Before Yen Strength | After Yen strength |

|---|---|---|

| Support for Local Brands | 65% | 50% |

| Interest in International Products | 35% | 50% |

This table highlights the shift in consumer preferences that businesses must navigate. The challenge will be to strike a balance between maintaining competitive pricing and quality while fostering brand loyalty in an evolving market landscape.

Future Outlook: What Rising Yen Means for Japanese Industries

The recent appreciation of the yen has sent ripples through various sectors of Japan’s economy, marking a significant shift for many industries that had enjoyed the benefits of a weaker currency. Manufacturers,which heavily rely on export markets,are now grappling with increased costs and shrinking profit margins. As the yen strengthens, the price competitiveness of Japanese goods abroad diminishes, compelling companies to adjust their pricing strategies. Notably, the automobile and electronics sectors, which thrived in the global market, may find themselves facing tighter margins and pushback from international buyers.

An equally critically important concern is the impact on import-dependent industries, which may experience cost reductions due to a stronger yen. The energy sector stands to benefit, as oil prices become relatively cheaper, potentially allowing for enhanced profitability.Additionally, businesses involved in importing raw materials could see a favorable shift as purchasing power increases. Though, the interplay of these factors highlights a broader economic challenge: while certain industries may flourish, others will struggle to adapt, leading to an uneven recovery that could reshape the landscape of Japan’s economy in the near future.

Recommendations for Investors in a Volatile Currency Environment

In light of the recent fluctuations in Japan’s currency, investors should adopt a cautious yet strategic approach to navigate the challenges posed by volatility. Currency swings can considerably impact earnings, particularly for multinational corporations that rely heavily on exports.To mitigate risks, consider implementing hedging strategies that can safeguard investments from unexpected currency movements. This may involve utilizing options or futures contracts to lock in favorable exchange rates, thereby stabilizing cash flows and preserving profit margins.

Moreover, diversifying investment portfolios remains imperative in such unpredictable times.Investors should explore opportunities beyond traditional equities, including bonds, real estate, or even foreign markets that may benefit from a strengthening yen. Investing in foreign-denominated assets can also provide a buffer against local currency appreciation. Here’s a speedy reference table for potential investment options during currency volatility:

| Investment Type | Risk Level | Potential Benefit |

|---|---|---|

| Bonds | Low | stable returns |

| Equities | Moderate | Growth potential |

| Foreign Assets | High | Currency advantage |

| Real Estate | Moderate | Inflation hedge |

Key Takeaways

the recent resurgence of the yen has presented a complex challenge for Japan Inc., which had previously flourished amidst a weaker currency. as firms grapple with shifting profit margins and the impacts of a stronger yen on global competitiveness, the balance between domestic stability and international market pressures becomes increasingly tenuous. The implications of this currency fluctuation extend beyond financial statements,affecting investment strategies,consumer behavior,and the broader economic landscape. As Japan Inc. navigates this transitional phase, stakeholders will need to remain vigilant and adaptive, recalibrating their expectations and strategies in light of the evolving economic environment. As this situation develops, the future trajectory of Japan’s corporate sector will depend on its ability to respond to these new realities. For ongoing updates and insights, stay tuned to reuters.com.