In a notable shift in the currency markets, the U.S. dollar has gained momentum against the New Taiwan dollar during trading sessions in Taipei. This upward movement reflects broader economic trends and fluctuating international market conditions. As investors closely monitor the implications of this shift, analysts are examining potential factors contributing to the dollar’s strength, including U.S. economic data, interest rate expectations, and geopolitical influences. In this article, we will delve into the specifics of the dollar’s performance in Taipei, explore the drivers behind its ascent, and assess what this may mean for trade and investment strategies moving forward.

U.S. Dollar Strengthens Against New Taiwan Dollar in Taipei Markets

The currency markets in taipei saw the U.S. dollar gain traction against the New Taiwan dollar, reflecting broader trends in global finance and investor sentiment. Analysts attribute this strengthening to several factors, including:

- Economic Indicators: Positive data releases from the U.S. have boosted confidence in the dollar.

- Interest Rate Expectations: Anticipation of further interest rate hikes by the Federal Reserve has made the dollar more attractive.

- Geopolitical Factors: Ongoing uncertainties in the region are prompting investors to seek safer assets.

this uptick in the dollar’s value is significant not just for international trade, but also for local consumers and businesses in Taiwan.Import costs may rise, leading to potential price increases on goods and services.Here’s a brief overview of the current exchange rates:

| Currency | Exchange rate |

|---|---|

| U.S. Dollar (USD) | 1 USD = 30.5 TWD |

| New Taiwan Dollar (TWD) | 1 TWD = 0.033 USD |

Factors Driving the Rise of the U.S. Dollar in Taiwan

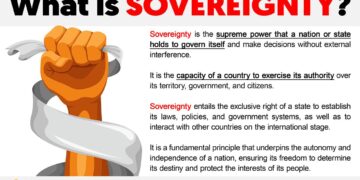

The recent surge of the U.S. dollar in Taiwan can be attributed to several pivotal factors reshaping the economic landscape. Primarily, the ongoing geopolitical tensions and trade relations between the U.S. and China have lead investors to favor the dollar as a safe-haven asset. The interest rate policies implemented by the Federal Reserve, aimed at combating inflation, have further strengthened the dollar’s appeal. As financial institutions adjust their strategies in response to these shifts, the influx of foreign investments into the U.S. markets has caused a ripple effect, impacting currency valuations worldwide.

Additionally, the export-driven economy of Taiwan heavily relies on robust demand for its technology products, which are increasingly priced in U.S. dollars. The tech sector’s performance has been solid, drawing global investors and creating a dynamic where the dollar remains strong against the Taiwanese dollar. Recent statistics illustrate this trend effectively:

| Month | U.S. Dollar to TWD Exchange Rate | Key economic Events |

|---|---|---|

| January | 28.5 TWD | Fed rate hike proclamation |

| February | 28.8 TWD | Increase in U.S. exports |

| March | 29.0 TWD | International trade tensions |

Impact of Currency Fluctuations on Local Businesses and Consumers

Currency fluctuations can substantially alter the landscape for local businesses and consumers, particularly when the U.S. dollar strengthens against the Taiwanese dollar. For local businesses that import goods, a higher dollar value can led to increased costs of foreign products. This surge in expenses may compel businesses to either absorb the costs or pass them on to consumers as price hikes. In this scenario, consumers may experience a shrinking selection of imported products and a rise in prices for everyday items, from electronics to clothing.

Conversely, a stronger U.S. dollar can also create opportunities for exporters looking to tap into international markets. When the local currency weakens, it makes Taiwanese products more competitive abroad, possibly leading to increased sales and revenue for local manufacturers. However, this advantage may not be felt equally across all sectors. Key areas affected include:

- Price adjustments for imports.

- Changes in consumer spending patterns.

- Variations in profit margins for exporters.

Ultimately, while currency strength can create winners and losers, the balancing act for businesses and consumers becomes essential to navigate the complexities of an ever-changing market.

Strategic Recommendations for Investors Amid Currency Changes

As the U.S. dollar continues to strengthen in Taipei trading, investors should recalibrate their strategies to navigate the evolving currency landscape. A strong dollar can lead to significant shifts in capital flows and investment opportunities. One suggestion is to closely monitor sectors that are typically resilient during times of currency appreciation,such as export-driven industries or companies with strong pricing power. These sectors might offer attractive returns as they benefit from favorable foreign exchange rates.

Moreover, diversifying international investments coudl help mitigate risks associated with currency fluctuations.Investors should consider areas where the local currencies may appreciate against the dollar, potentially capturing gains from shifts in global economic dynamics. Factors to analyse for potential investment include:

- Emerging markets with improving economic fundamentals

- Commodities that could benefit from a weakening dollar

- Foreign currency-denominated bonds offering higher yields

Utilizing hedging strategies and staying informed on macroeconomic indicators will also be crucial in making prudent investment decisions.

Outlook for the U.S. Dollar and Economic Implications for Taiwan

The recent uptick in the value of the U.S. dollar during trading sessions in Taipei underscores a number of implications for Taiwan’s economy. As the dollar gains strength, Taiwanese exports could face heightened competitive pressures in international markets, particularly against countries whose currencies may depreciate in comparison. This scenario presents both challenges and opportunities:

- Export Competitiveness: A stronger dollar may raise the cost of Taiwanese goods abroad, potentially dampening demand.

- Import Costs: Taiwan relies on imports for a variety of essential goods; so, a stronger dollar might increase costs for imported products.

- Foreign Investment: A robust dollar could attract foreign investments into the U.S., diverting attention from Taiwan, though it may enhance Taiwan’s tech product allure with more favorable production costs.

Moreover,the shift in currency strength can influence Taiwan’s monetary policy decisions. As inflation dynamics evolve and global trading conditions shift, the central bank might consider several key strategies:

| Strategy | Description |

|---|---|

| Interest Rate Adjustments | Modifying rates to stabilize the economy in response to dollar fluctuations. |

| currency Reserves Management | Shifting reserves to buffer against adverse effects of dollar appreciation. |

| Trade Agreements | Seeking new agreements to maintain market access amidst fluctuating currency values. |

Navigating Currency Risks in International Trade and Investments

The recent surge in the U.S. dollar value against the New Taiwan dollar in Taipei trading has significant implications for businesses engaged in international trade and investments. Currency fluctuations can affect everything from pricing strategies to profit margins,making it critical for companies to adopt proactive measures in their financial planning. As the dollar strengthens,imports become more expensive,potentially squeezing profit margins for importers,while exporters could benefit from more competitive pricing overseas. Companies must continuously monitor currency trends and consider employing financial instruments such as hedging to mitigate the risks associated with foreign exchange volatility.

To effectively manage currency risks, businesses should consider the following strategies:

- Regular Currency Assessments: Evaluating currency exposure on a regular basis can help in making informed decisions regarding pricing and budgeting.

- Utilization of Derivatives: Financial instruments, such as futures and options, can provide a safety net against unfavorable currency movements.

- Diverse Supplier and Customer Base: Expanding the geographical reach of suppliers and customers can help balance currency risk across different markets.

- Contractual Agreements: Negotiating contracts in a stable currency can provide price certainty and reduce exposure to volatile exchange rates.

This practice not only enhances financial stability but also positions businesses to seize opportunities presented by favorable currency shifts. By implementing robust currency management strategies, companies can navigate the complexities of international trade with greater confidence and resilience.

Key Takeaways

the recent rise of the U.S. dollar in Taipei trading reflects a complex interplay of economic factors both domestically and internationally. As investors and analysts continue to monitor fluctuations in exchange rates, the implications for trade, investment, and currency stability in Taiwan remain significant. The strength of the dollar can impact import costs, tourism, and export competitiveness, making it a critical point of interest for policymakers and business leaders alike. As the global economic landscape evolves, stakeholders will need to stay attuned to these developments to navigate the challenges and opportunities that come with a stronger U.S. dollar.