As global markets navigate a complex landscape of economic uncertainties, Wall Street faced a muted pre-bell atmosphere influenced by recent tariff debates and heightened caution surrounding artificial intelligence developments. Meanwhile, Asian and European indices demonstrated a contrast by posting gains, fueled by optimistic investor sentiment and resilient economic indicators. This article delves into the intricate dynamics shaping current market trends, exploring how tariff negotiations may impact trade relationships and the cautious optimism around AI advancements.We will also examine the reactions of global markets and provide insights into potential future movements as investors adapt to an ever-evolving financial environment.

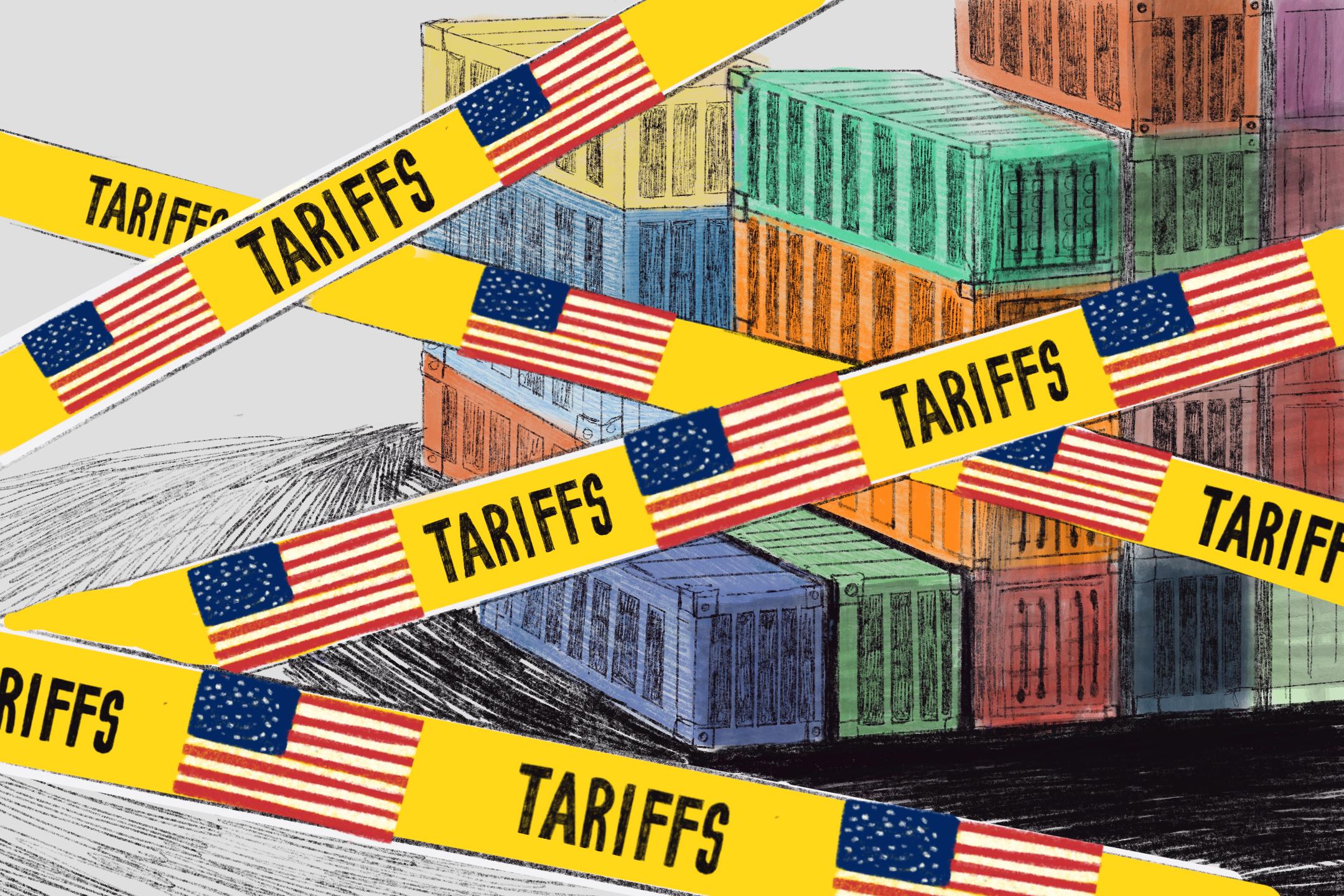

tariffs Loom Over Market Sentiment As Wall Street Prepares for Opening

the looming threat of tariffs continues to rattle investor sentiment as Wall Street braces for the marketS opening. With trade negotiations in a state of uncertainty, analysts are keenly monitoring how these developments will influence corporate earnings and consumer spending. The potential for increased tariffs has a multifaceted impact on various sectors,especially those heavily reliant on global supply chains. Key concerns revolve around:

- Profit Margins: Rising costs may erode profitability for many companies.

- Consumer Prices: Higher tariffs could lead to increased prices for consumers, dampening demand.

- Market Volatility: the unpredictability surrounding tariffs may heighten market fluctuations.

Meanwhile, Asian and European markets have shown a degree of resilience, pushing upwards in early trading sessions. Increased investments in artificial intelligence (AI) technologies are attracting investor interest, suggesting a potential shift as companies aim to innovate amid economic challenges. Sector impacts are evident, with a notable uptick in technology stocks, reflective of growing optimism in future-forward industries. Key data points to watch include:

| Region | Market Performance | Notable Movements |

|---|---|---|

| Asia | +1.2% | Tech stocks leading the charge |

| Europe | +0.9% | Mixed responses in industrial sectors |

AI Developments trigger Caution Among Investors Ahead of Trading

Recent advancements in artificial intelligence (AI) technology have sparked a wave of caution among investors, particularly as concerns grow over potential regulatory measures and market volatility. Analysts are highlighting several factors that contribute to this sentiment:

- Regulatory Uncertainty: As governments around the world begin to draft regulations targeting AI, investors are wary of how these rules may impact tech companies’ growth prospects.

- Market Volatility: Rapid innovations in AI have lead to meaningful fluctuations in tech stock prices,creating an environment of uncertainty that is making investors hesitant.

- Increased Competition: The AI landscape is becoming increasingly crowded, with major players and startups vying for dominance, raising concerns about sustainability and profitability.

Considering these developments, investment strategies are being re-evaluated. Many are turning to more conventional sectors,seeking stability amid the unpredictability of the tech market. To illustrate this shift, the following table highlights the performance of key sectors as investors adjust their portfolios:

| Sector | Performance Change (%) | Investor Sentiment |

|---|---|---|

| Technology | -3.5 | Bearish |

| Healthcare | +1.2 | Neutral |

| Consumer Goods | +2.4 | Bullish |

Asia Markets Show Resilience Amidst Global Economic Concerns

Despite lingering uncertainties in the global economy, Asia’s markets have showcased a remarkable ability to withstand external pressures, buoyed by strong domestic demand and supportive government policies. Key indices across the region recorded notable gains, driven by investor optimism in sectors such as technology, renewable energy, and consumer goods. in this environment, traders are focusing on the implications of recent developments, such as:

- Resilient corporate earnings indicating robust growth potential amidst economic headwinds.

- Government stimulus measures aimed at bolstering economic activity and consumer confidence.

- Increased foreign investments reflecting sustained interest in regional markets.

Meanwhile, investor sentiment remains cautious elsewhere, particularly in the West, where concerns over new tariffs and artificial intelligence regulations have begun to shape trading behaviors. European markets have also seen a lift, benefiting from optimism that parallels the Asian rebound. Factors contributing to this positive trajectory include:

| Factor | Impact |

|---|---|

| Tariff Developments | potential for reduced barriers encouraging trade. |

| AI Regulation Updates | Market relief as clarity fosters innovation. |

| Global Economic Indicators | Positive signals supporting recovery across markets. |

European Indices Gain Ground as Investor Optimism Persists

European indices showed a significant uptick today, buoyed by continued investor optimism despite ongoing concerns in other markets. The strength in Europe is attributed to positive earnings reports from key companies, which have helped stabilize sentiment amidst mixed signals from the global economy. Analysts note that traders are particularly encouraged by:

- Stronger corporate earnings surpassing expectations in various sectors.

- Projections of GDP growth indicating resilience in major economies.

- Positive consumer sentiment as people adapt to changing economic conditions.

Similarly, macroeconomic indicators from the Eurozone continue to reflect stability. Economic reports released earlier in the week showed steady inflation rates and improving employment figures, which suggest a strong rebound trajectory. Market participants are now keeping an eye on the European central Bank’s upcoming decisions, with hopes that it will maintain supportive monetary policies. Key data influencing market dynamics includes:

| Indicator | Value | Change |

|---|---|---|

| Eurozone GDP Growth | 2.5% | +0.3% |

| inflation Rate | 4.2% | -0.1% |

| Unemployment Rate | 6.7% | -0.2% |

impact of Tariff Regulations on Sector-Specific Stocks

The recent shift in tariff regulations has stirred significant fluctuations across various sectors, prompting a mixed reaction in stock performance. Tariffs,particularly on imports,have a direct effect on manufacturing costs and consumer prices,influencing the earnings outlook for companies within affected industries. Sectors such as technology, automotive, and consumer goods may experience profitability challenges as tariffs could lead to increased operational expenses.this has necessitated a closer examination of the stocks in these sectors, as investors reconsider their positions amid a backdrop of regulatory uncertainty.

Additionally, the response from markets demonstrates a clear correlation between tariff announcements and stock volatility. As an example, industries reliant on imports may see a downturn, while those capable of passing on costs to consumers might weather the storm better. The impact can be illustrated through a comparative analysis of key sector-specific stocks, aimed at giving investors insights into potential outcomes based on different tariff scenarios. Below is a summary table showcasing select sectors and their estimated sensitivity to tariff changes:

| Sector | Estimated Sensitivity | Potential Impact on Stocks |

|---|---|---|

| Technology | High | Increased costs may hurt margins |

| Automotive | Medium | price hikes may lead to lower sales |

| Consumer Goods | Medium | Ability to pass on costs is crucial |

Navigating the Balance Between AI Advancements and Market Stability

The rapid expansion of artificial intelligence (AI) technologies poses both opportunities and challenges for market stability. On one hand, AI has the potential to drive significant efficiencies, enhance trading strategies, and optimize investment decisions.Yet, these advancements can also lead to increased volatility as algorithmic trading systems rapidly react to market events. Market participants must adapt to a new reality where decisions are increasingly influenced by AI capabilities, leading to an ever-accelerating pace of market changes.

Moreover, the regulatory landscape surrounding AI remains uncertain, creating a cautious atmosphere among investors. key considerations include:

- Data Privacy: Ensuring compliance with data protection laws while leveraging large datasets for AI training.

- Market Manipulation Risks: Addressing concerns over AI-driven strategies that could inadvertently disrupt market integrity.

- Ethical standards: establishing frameworks to govern AI applications in finance to maintain consumer trust.

These factors highlight the need for a balanced approach to AI adoption in the financial sector, fostering innovation while safeguarding against potential market disruptions.

investment Strategies During Periods of Economic Uncertainty

In times of economic uncertainty, investors often face challenging decisions that require a careful balance between risk and prospect. Strategies that focus on defensive positioning can be particularly beneficial. Consider reallocating a portion of your portfolio towards sectors that historically outperform during downturns, such as utilities, consumer staples, and healthcare. Additionally, building a laddered bond portfolio can provide stability and consistent income, mitigating the risks associated with equities’ volatility.

Another strategy is to diversify geographically, which can help shield your investments from domestic economic fluctuations. Look for international markets that may be less affected by tariff battles or geopolitical tensions. For investors willing to engage with more unconventional approaches, consider focusing on option assets like real estate or commodities, which can serve as a hedge against inflation and currency devaluation. Understanding the nuances of these financial instruments can be integral to maintaining a resilient portfolio during unpredictable times.

Expert Insights on Psychological Factors Affecting Investor Behavior

Investor behavior is frequently enough influenced by a myriad of psychological factors that can create ripple effects in the market. Cognitive biases, such as overconfidence and loss aversion, play a significant role in decision-making processes. These biases often lead investors to take excessive risks or to sell off assets too quickly during downturns, driven by fear rather than logic. Furthermore, social dynamics such as herding behavior can exacerbate market volatility. When investors see others moving in a particular direction,they may follow suit without fully assessing the underlying fundamentals,resulting in rapid price fluctuations.

Emotional states, such as fear and excitement, can also dramatically alter the landscape of investor sentiment. In uncertain times—like the current economic climate influenced by tariffs and technological caution—investors may rely more on instinct than on data-driven analysis. This shift can lead to an influx of irrational behavior in the market. Understanding these psychological nuances is crucial, as they not only affect individual trades but can, over time, shape the broader market trends. assessing investor sentiment through tools measuring fear and greed may provide valuable insights into potential market turns.

Looking Ahead: Key Economic Indicators to Watch This Week

This week, investors should closely monitor several key economic indicators that could significantly influence market sentiment. The focus will be on the upcoming Consumer Price Index (CPI) report scheduled for release midweek. Given that inflation concerns continue to impact monetary policy decisions, a deviation from expected figures could stir volatility in equity markets. Additionally, the producer Price Index (PPI) will be released alongside, providing insight into wholesale pricing trends. Both reports are crucial as they gauge inflation at different stages and may affect interest rate strategies by the Federal Reserve.

Furthermore, the market will react to updates on retail sales data, crucial for understanding consumer spending patterns. As an indicator of economic health, rising sales figures would signal strong demand, while any downturn might raise concerns about consumer confidence. Moreover, the Jobless Claims report offers valuable insights into labor market stability.With a backdrop of potential tariff implications on imports and ongoing developments in artificial intelligence regulations,the economic landscape this week could shift rapidly based on these reports.

Recommendations for Diversifying Portfolios in Response to Global Risks

In light of the fluctuating economic climate driven by global uncertainties, investors are urged to reconsider their strategies. Diversification remains a cornerstone of risk management, enabling portfolios to withstand shocks from various sectors. To navigate these tumultuous waters effectively, consider incorporating a mix of asset classes such as:

- Emerging market Equities: Tap into growth potential in regions poised for rapid development.

- Commodities: Include precious metals and energy resources to hedge against inflation and currency fluctuations.

- Real Estate Investment Trusts (REITs): Diversify into physical assets, offering potential for capital appreciation and income generation.

- Cryptocurrencies: In small allocations,explore digital currencies as a hedge and for high-risk,high-reward opportunities.

Additionally, investors should assess geographical exposure and industry sectors to avoid concentration risk. Allocating investments across different regions and sectors can mitigate the impact of localized downturns. A sample portfolio allocation might look like this:

| Asset class | Percentage allocation |

|---|---|

| U.S. Equities | 30% |

| International Equities | 20% |

| Real Estate | 15% |

| Fixed Income | 25% |

| Alternatives (Commodities/Crypto) | 10% |

To Wrap It Up

as traders prepare for the U.S. market open,the cautious sentiment stemming from ongoing tariff discussions and potential implications regarding artificial intelligence regulation continues to shape Wall Street’s outlook. Though, the uptick in Asian and European markets indicates a resilient global economic landscape, suggesting that investors remain optimistic despite looming challenges. As we navigate these complexities, it will be essential for market participants to stay informed and agile, ready to respond to the evolving dynamics influencing the financial landscape.As we turn our focus to today’s trading session, all eyes will be on how these developments unfold in real-time and what they could meen for the future trajectory of the markets. Stay tuned for further updates and analysis as we assess the impact of these factors on investment strategies in the days ahead.