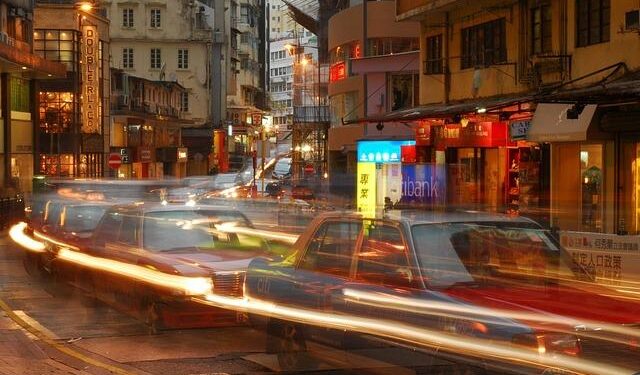

In recent months, Hong Kong has found itself at the epicenter of an unpredictable global market, as traders navigate the turbulent waters of economic uncertainty and geopolitical tensions. the city’s vibrant trading landscape, once seen as a beacon of stability and chance, is now grappling with the dual challenges of rising inflation and shifting supply chains. As the world watches closely, Hong Kong’s traders are adapting to a dynamic habitat shaped by rapid changes in consumer behavior and international relations. In this article, we delve into the strategies employed by these market players, the challenges they face, and what the future might hold for one of Asia’s financial powerhouses amid a global market storm.

Hong Kong Traders Navigate Volatile Market Conditions Amid Global Uncertainty

In recent weeks, traders in Hong Kong have been grappling with turbulence in the financial markets, driven by a confluence of global events that have left many uncertain about the trajectory of economies worldwide. Key factors influencing this volatility include:

- Rising Interest Rates: Central banks are tightening monetary policies to combat inflation, which has direct repercussions on investment strategies.

- Geopolitical Tensions: Ongoing conflicts and diplomatic strains are creating apprehension among investors, leading to fluctuating stock prices.

- Supply Chain disruptions: Continued challenges related to global supply chains are affecting profitability forecasts for numerous sectors.

Despite these challenges, Hong kong traders are employing strategic methods to adapt and thrive in this unpredictable environment. Many are focusing on:

- Diversification: Spreading investments across various sectors to mitigate risks associated with market downturns.

- Utilizing Technology: Leveraging advanced trading platforms and analytics tools to gain real-time insights into market shifts.

- Short-term trading Strategies: Adopting more agile trading tactics to capitalize on quick price movements amidst uncertain market conditions.

| Market Driver | Impact on Traders |

|---|---|

| Interest Rates | Increased borrowing costs and shifts in investment patterns |

| Geopolitical Risks | Heightened market fluctuations and investment caution |

| Supply chain Issues | Increased operational costs and uncertain stock availability |

Strategic Adaptations: How Local Traders Are Responding to International Market Shifts

As the global market undergoes significant fluctuations,local traders in Hong Kong are demonstrating remarkable resilience by implementing a range of strategic adaptations. These traders are increasingly focusing on diversification to mitigate risks associated with international trade disruptions. Key strategies include:

- Product Diversification: Expanding into new product lines that cater to shifting consumer preferences.

- Supply Chain Optimization: Establishing more localized supply chains to reduce dependence on international suppliers.

- Technological Integration: Leveraging e-commerce platforms to reach a broader audience and to facilitate smoother transactions.

Moreover, local traders are engaging in collaborations with regional partners to forge stronger networks, ensuring steady cash flow while navigating the unpredictable dynamics of global markets. This collaborative approach has seen the rise of co-marketing initiatives and shared resources that enable traders to maintain competitiveness. The following table illustrates some of the sectors showing growth as traders adapt their strategies:

| Sector | Adaptation Strategy | Projected Growth Rate |

|---|---|---|

| retail | E-commerce Expansion | 15% |

| Food & Beverage | Local Sourcing | 10% |

| Tech Startups | Partnerships for Innovation | 20% |

Future Outlook: Enhancing Resilience and Capitalizing on emerging Opportunities in Hong Kong’s Trading Landscape

As Hong Kong’s trading environment continues to evolve under the influence of global economic shifts, the resilience of its traders will be crucial for capturing new opportunities. The local market is already witnessing an increase in demand for digital assets and fintech solutions, prompting traders to adapt swiftly. Key strategies for enhancing resilience include:

- diversification: Expanding portfolios to include a mix of conventional and emerging asset classes.

- Technological Integration: Leveraging advanced trading platforms and analytics to improve decision-making.

- Collaboration: Partnering with local and international firms to share knowledge and resources.

Moreover, the outlook for Hong Kong traders hinges on embracing regulatory changes that favor innovation. With the global push for sustainability and responsible investing, traders can position themselves at the forefront by focusing on green finance and ESG-compliant investments. A recent analysis highlights the importance of agility in the market,indicating that:

| Opportunity | Potential Impact |

|---|---|

| Digital Assets | High growth potential due to rising interest |

| Sustainable investments | Attracting socially conscious investors |

| Regulatory Technology | Streamlining compliance processes |

Traders who proactively adapt to these transformations will not only survive but thrive in the face of ongoing global market challenges. Emphasizing continuous education and embracing innovative solutions will be imperative for maintaining competitiveness in this vibrant trading hub.

Concluding Remarks

As Hong Kong finds itself at the crossroads of geopolitical tensions and economic uncertainties, traders in the region are navigating an increasingly volatile global market landscape. The convergence of local challenges and international dynamics underscores the resilience and adaptability required to thrive in these tumultuous times. With the evolving regulatory environment, shifting consumer behaviors, and the ongoing impacts of the pandemic, traders are urged to re-evaluate their strategies and cultivate innovative approaches to remain competitive. As we continue to monitor the developments in Hong Kong and their ripple effects across the global economy, one thing remains clear: the ability of these traders to weather the storm will be crucial not only for their own futures but also for the broader economic stability of the region. In a world where markets are in constant flux, the eyes of the global community will undoubtedly remain fixed on Hong Kong’s traders as they adapt to the challenges and opportunities ahead.