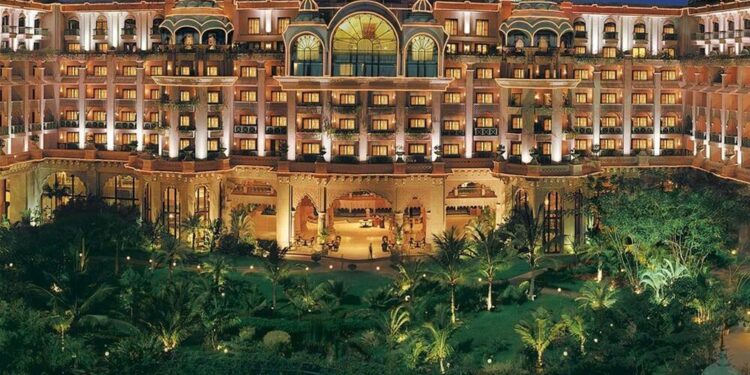

In a significant development in the Indian hospitality sector, the owner of the prestigious Leela Palaces has announced plans to scale back its initial public offering (IPO). The move comes amid a challenging market environment and reflects the company’s strategic decision to reassess its fundraising approach. Known for its luxury accommodations and exceptional service, the Leela brand is synonymous with opulence in India’s vibrant tourism landscape. As the company navigates these complex market dynamics, stakeholders are keenly observing the potential implications for both the Leela Palaces and the broader hospitality industry. This article delves into the details of the IPO adjustment, exploring the underlying factors influencing this decision and what it may mean for the future of one of India’s most celebrated luxury hotel chains.

Owner of India’s Leela Palaces Adjusts IPO Plans Amid Market Volatility

The hospitality group behind India’s prestigious Leela Palaces has revised its initial public offering (IPO) strategy in light of recent fluctuations in market conditions. This shift comes amid an increasingly cautious investment climate, characterized by heightened volatility and a global economic slowdown. The company, which owns and operates several luxury hotels across India, is now considering a more modest capital raise than originally planned, aiming to enhance flexibility and mitigate risk during these unpredictable times.

In a recent announcement, the firm outlined several key factors influencing this decision:

- Market Conditions: Uncertainty regarding interest rates and geopolitical tensions have prompted a re-evaluation of the IPO.

- Investor Sentiment: Potential investors have shown increased reluctance, emphasizing the need for a more cautious approach.

- Strategic Focus: The company aims to strengthen its existing portfolio and improve operational efficiencies before pursuing aggressive expansion.

| Original IPO Plan | Revised IPO Plan |

|---|---|

| $500 million | $300 million |

| National Launch | Selective Markets |

| Rapid Expansion | Stabilization Efforts |

Strategic Insights into the Luxury Hospitality Sector and Investment Implications

The ongoing shifts within the luxury hospitality sector present both challenges and opportunities for investors, particularly as the owner of India’s Leela Palaces seeks to trim its initial public offering (IPO) aspirations. With a keen focus on maintaining high occupancy rates and exceptional guest experiences, companies like Leela are navigating a complex landscape marked by fluctuating demand and economic pressures. As the sector rebounds from the impacts of the pandemic, strategic positioning becomes crucial. Investors must consider several factors when analyzing this sector:

- Market Demand Trends: Understanding consumer preferences is vital, especially as the luxury market evolves to cater to a more discerning clientele.

- Technological Integration: Embracing cutting-edge technology for personalized experiences can set luxury brands apart, influencing investor confidence.

- Geographical Diversification: Expanding into emerging luxury markets can mitigate risks and enhance growth potential.

Furthermore, the decision to scale back on IPO plans indicates a cautious approach, reflecting broader trends in the luxury hospitality sector. Investors should closely monitor the implications of such moves, as they can signal underlying financial health or shifts in operational strategies. The following table highlights key luxury hospitality investments and their projected returns, underscoring the potential for discerning investors:

| Investment Opportunity | Projected ROI | Market Outlook |

|---|---|---|

| Luxury Boutique Hotels | 12-15% | Positive, driven by experiential travel |

| High-End Hospitality Tech | 10-13% | Growing, with increased focus on customer service |

| Eco-Luxury Resorts | 8-11% | Promising, as sustainability becomes a priority |

Recommendations for Investors Following the Leela Palaces IPO Developments

In light of the recent developments surrounding the Leela Palaces IPO, investors are advised to approach this opportunity with caution. The company’s decision to reduce its initial public offering reflects a significant adjustment in market sentiment. As potential stakeholders consider their options, it is crucial to evaluate the following factors:

- Market Conditions: Assess the current state of the stock market and its impact on hospitality sector valuations.

- Company Performance: Review the financial health of Leela Palaces, including past performance and growth projections.

- Competitive Landscape: Investigate how Leela stands against its competitors in the luxury hotel space, particularly during times of economic volatility.

Moreover, prospective investors should also stay informed about any regulatory changes that could affect the IPO timeline. Engaging with industry analysts and monitoring real-time market news can provide valuable insights. Below is a summary of key indicators to consider when evaluating the investment:

| Indicator | Status |

|---|---|

| Revenue Growth | Stable |

| Debt Levels | Moderate |

| Market Sentiment | Cautious |

Final Thoughts

In conclusion, the owner of India’s prestigious Leela Palaces has prompted discussions in the financial realm by seeking to reduce the scale of its initial public offering (IPO). This move reflects a strategic pivot amidst fluctuating market conditions and evolving investor sentiments. As stakeholders monitor these developments closely, the implications for both the luxury hospitality sector and the broader investment landscape in India remain to be seen. As the situation unfolds, industry observers will be keen to assess how this decision will influence the trajectory of the Leela brand and its positioning in an increasingly competitive market. Further updates will shed light on this evolving story as the company navigates the complexities of its public offering.