Goldman Sachs Strengthens Asia Real Estate Holdings with Fukuoka Apartment Purchase

Goldman Sachs has recently expanded its real estate portfolio by acquiring a collection of apartment units in Fukuoka, Japan, from CapitaLand Ascott Trust. This acquisition highlights the increasing attractiveness of Japan’s residential property market, especially in cities like Fukuoka that are witnessing heightened demand for quality rental accommodations. The transaction not only reinforces Goldman Sachs’ strategic intent to deepen its presence in key Asian urban centers but also reflects the intensifying competition among global investors targeting Japan’s stable and promising real estate sector.

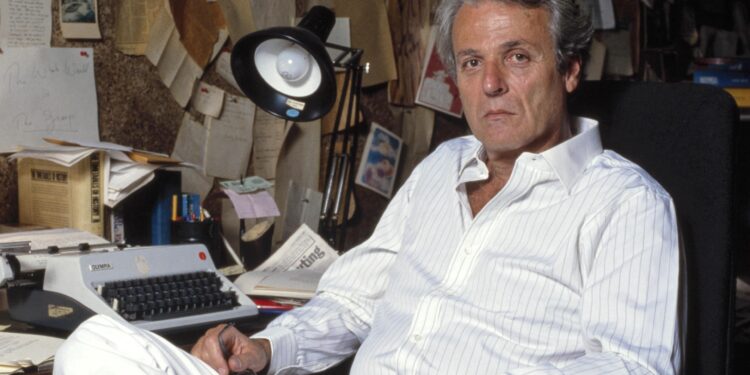

Fukuoka stands out as a dynamic city combining economic vitality with cultural richness, making it an appealing destination for both local residents and expatriates. With urban living gaining renewed popularity post-pandemic, this deal signals strong confidence in the city’s long-term housing market prospects.

Overview of the Acquisition and Market Context

The portfolio acquired by Goldman Sachs consists of modern apartment complexes equipped with contemporary amenities designed to meet diverse tenant needs. Located strategically near major transportation networks and commercial districts, these properties are well-positioned to attract a broad spectrum of renters including young professionals and international residents.

- Prime Urban Location: Situated within thriving neighborhoods offering easy access to public transit and business hubs.

- Up-to-Date Facilities: Incorporating advanced features such as smart home technology and communal spaces tailored for modern lifestyles.

- Sustained Rental Demand: Supported by an expanding expatriate population alongside growing domestic interest fueled by tourism recovery.

This acquisition aligns with a wider movement among institutional investors who are increasingly drawn to Japan due to its resilient economy, favorable demographic shifts—including an influx of younger workers into regional cities—and government initiatives promoting urban development.

CapitaLand Ascott Trust’s Strategic Divestment Amid Changing Market Dynamics

In response to evolving consumer preferences and fluctuating demand patterns within the real estate sector, CapitaLand Ascott Trust opted to divest its Fukuoka apartment holdings. This decision is part of their broader strategy aimed at optimizing asset allocation by focusing on core markets where operational efficiencies can be maximized. By selling these residential units—comprising approximately 250 apartments across two prime properties—the trust is positioning itself for reinvestment into emerging regions that promise higher growth potential over the coming years.

| Property Name | Location | No. of Units Sold | Estimated Transaction Value (USD) |

|---|---|---|---|

| Kawabata Residence | Fukuoka City Center | 100 | $30 million |

| Momochi Heights Apartments | Momochi District, Fukuoka | 150 | $45 million |

| KPI Metric | Fukuoka Apartments | Japan National Average |

|---|---|---|

| Current Gross Rental Yield | 5 . 2 % | 4 .1 % |

| Projected Annual Price Growth Rate

&n bsp; & nbsp; & nbsp; 3 .5 %& nbsp ; 20% | 3 .5 %& nbsp ;< / td > | 20%< / td > < / tr > |

| Occupancy Rate< / td > | 95%< / td > | 90%< / td > < / tr > |