Philippines Records Significant Inflation Slowdown in May; Central Bank Hints at Policy Adjustment

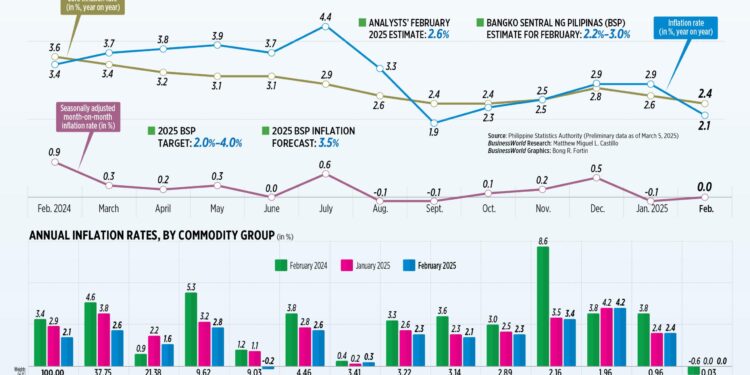

In a promising development for the Philippine economy, inflation rates continued their downward trajectory in May, offering relief to consumers and signaling potential shifts in monetary policy. Recent figures from the Philippine Statistics Authority indicate a marked reduction in the year-on-year inflation rate, driven largely by easing prices in essential sectors such as food and energy. This trend has prompted the Bangko Sentral ng Pilipinas (BSP) to consider loosening its previously tight monetary stance amid persistent concerns over cost pressures and economic stability.

Experts believe this sustained moderation of inflation could grant the BSP greater flexibility to adjust interest rates, potentially fostering an environment conducive to renewed economic expansion. The central bank’s cautious approach reflects an effort to balance growth stimulation with price stability as global uncertainties continue to influence domestic markets.

Key Drivers Behind Inflation Moderation

The decline observed in May is part of a broader trend that has unfolded over recent months. Notably:

- Food prices have stabilized: Improved supply chains and favorable weather conditions have helped temper increases in staple goods.

- Energy costs eased: Global oil prices softened slightly after earlier surges, reducing transportation and utility expenses.

- Consumer Price Index (CPI) trends: The CPI reflected these sectoral improvements, contributing significantly to overall inflation deceleration.

This easing enhances household purchasing power which had been eroded by previous spikes—offering some breathing room for Filipino families managing tight budgets amid ongoing economic challenges.

| Month | Inflation Rate (%) |

|---|---|

| January | 8.6 |

| February | 8.4 |

| March | 7.6 |

| April | 6.6 |

| May | 6.1 |

Monetary Policy Outlook Amid Easing Inflation: Implications for Growth and Interest Rates

The gradual slowdown of inflation opens up discussions about possible adjustments in BSP’s monetary policy framework—particularly regarding interest rate decisions that have remained elevated throughout much of this year as a countermeasure against rising prices.

A potential reduction in benchmark rates could stimulate various facets of the economy by making borrowing more affordable for both consumers and businesses alike:

- Burgeoning consumer demand: Lower financing costs typically encourage households to increase spending on durable goods, services, and discretionary items.

- An upswing in corporate investments: Firms may leverage cheaper credit lines for capital expenditures such as upgrading technology or expanding operations across emerging industries like renewable energy or digital infrastructure.

- A revitalized real estate market: More accessible mortgage rates can attract first-time homebuyers or investors seeking residential properties — potentially boosting construction activity nationwide.

- The financial markets are expected to respond positively if BSP signals accommodative policies ahead — particularly benefiting sectors sensitive to borrowing costs such as utilities, consumer discretionary stocks, and infrastructure projects.

- The central bank’s decision-making will also be influenced by external factors including global commodity price fluctuations and geopolitical developments impacting trade flows.

- A balanced approach remains critical: while lowering interest rates can spur growth momentum post-pandemic recovery phase, safeguarding against premature loosening is essential given lingering inflation risks worldwide.

- Create prioritized spending plans : Focus resources on essentials while remaining vigilant toward possible future price changes due mainly seasonal factors affecting food supply chains or fuel costs.

- < b > Strengthen emergency savings cushions :< / b >& #160 ; Build reserves sufficient enough so unexpected shocks do not derail financial security .< br />< / li >

- < b > Hunt value deals actively :< / b >& #160 ; Take advantage of promotions , discounts , bulk buying options available locally especially during festive seasons .< br />< / li >

For investors looking ahead at evolving macroeconomic signals:

- < strong>Diversify investment portfolios :& #160 ; Spread risk exposure across multiple asset classes including equities , bonds , real estate investment trusts (REITs),and emerging tech ventures .< br />< / li >

- < strong>Pursue growth-oriented stocks :& #160 ; Identify companies positioned well within recovering sectors like consumer staples , healthcare innovation,and green technologies benefitting from supportive government policies .< br />< / li >

- < strong>Keenly monitor central bank announcements :& #160 ; Stay informed about BSP’s policy moves since they directly impact fixed income yields along with lending environments influencing corporate profitability .< br />< / li >

Recommended Strategy Target Audience Action Points < tr >

< td > Budget Management < / td >

< td > Consumers < / td >

< td > Prioritize Spending | Save More | Seek Discounts < / td >< / tr>< tr>

Final Thoughts on Philippine Inflation Trends & Monetary Policy Trajectory

The steady deceleration of inflation throughout early-to-mid 2024 marks an encouraging turning point within the Philippines’ complex economic landscape—relieving some pressure off both consumers grappling with rising living costs as well as businesses navigating uncertain demand patterns.

The Bangko Sentral ng Pilipinas’ openness toward adjusting its monetary stance underscores proactive efforts aimed at nurturing sustainable growth without compromising long-term price stability amid volatile international conditions.

While optimism grows around prospects for lower interest rates stimulating consumption & investment activities alike,—caution remains warranted given unpredictable external shocks that could reignite upward price pressures.

Stakeholders—from policymakers through private sector participants—will closely observe forthcoming developments over coming quarters since these decisions will shape trajectories impacting employment levels, capital flows,& overall macroeconomic resilience moving forward into late 2024 and beyond.

| Economic Indicator | Expected Effect with Lower Interest Rates |

|---|---|

| Consumer Expenditure Increase | 3-5% Growth Projected |

| Corporate Capital Investments Increase | 4-6% Rise Anticipated |

| Housing Market Activity Boosted By Cheaper Mortgages < | 5-7% Uptick Expected In Transactions And Prices < / td > |

Navigating Economic Shifts: Practical Advice for Consumers & Investors Amid Changing Conditions

As inflation pressures ease across key commodities within the Philippines’ economy during mid-2024, both households (consumers) ,and investors face new opportunities—and challenges—to optimize their financial strategies accordingly.

For everyday Filipinos managing household budgets amidst fluctuating market conditions: