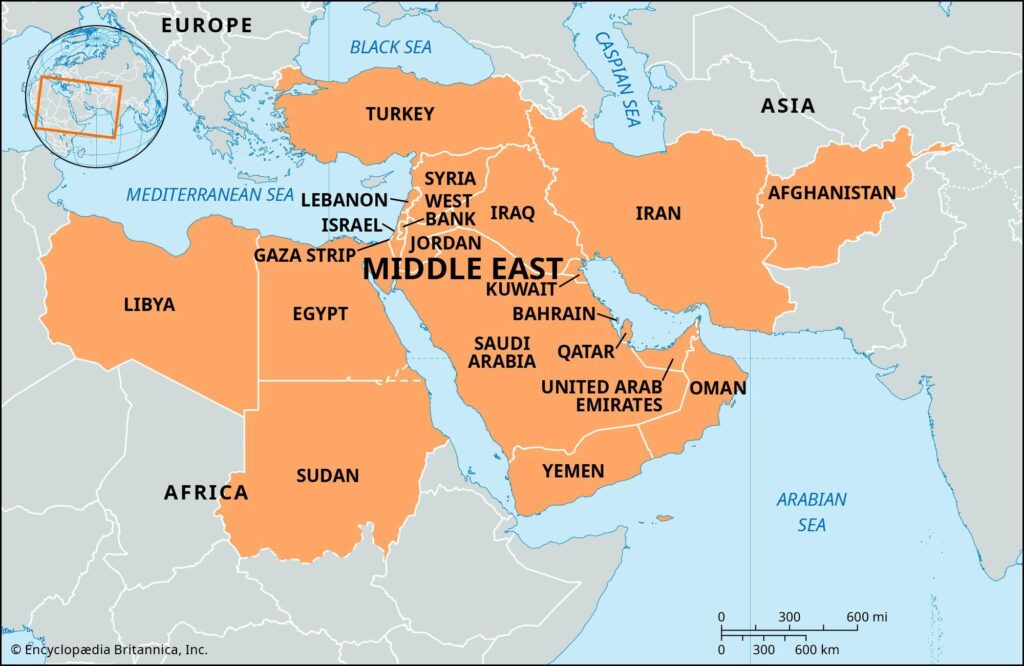

Middle East Tensions and Their Impact on Global Energy Stability

As geopolitical strains persist across the Middle East, specialists at the Center for Strategic and International Studies (CSIS) are raising urgent concerns about potential disruptions to energy supplies originating from this critical region. Despite ongoing diplomatic dialogues and assurances from various governments, experts caution that it remains too soon to discount the possibility of instability affecting worldwide energy markets. CSIS’s latest analysis highlights a complex web of risks tied to political volatility in oil-rich countries, emphasizing how regional conflicts intertwine with energy supply networks and global economic health. With demand for energy climbing steadily amid price fluctuations, grasping the fragile power dynamics in this area is more vital than ever. This article delves into CSIS’s key findings while exploring broader consequences for international energy security.

Understanding Vulnerabilities in Middle Eastern Energy Supplies

The geopolitical landscape of the Middle East presents numerous challenges that threaten uninterrupted energy flows. Nations such as Iran, Saudi Arabia, and the United Arab Emirates frequently experience tensions that jeopardize critical trade corridors and infrastructure essential for oil production and distribution. The primary risks include:

- Escalation into Armed Conflict: Heightened hostilities could severely disrupt extraction activities.

- Cybersecurity Threats: Increasingly sophisticated cyberattacks pose significant dangers to operational continuity within energy sectors.

- Political Flux: Sudden leadership changes may undermine investor confidence in long-term projects.

Apart from human factors, environmental challenges such as extreme weather events add layers of unpredictability to supply stability—highlighted recently by missile strikes claimed by Yemen’s Houthi rebels targeting Saudi facilities (source). To counter these threats effectively, nations must pursue diversified energy portfolios alongside enhanced regional cooperation frameworks. Below is an overview of notable incidents over recent years that have shaken confidence in reliable supply chains:

| Date | Description | Consequences | ||||||

|---|---|---|---|---|---|---|---|---|

| 2019 | The drone assault on Saudi Aramco facilities disrupted operations significantly. | Dramatic reduction in crude output temporarily tightened markets. | ||||||

| 2020 | Tensions between Iran and U.S. escalated following targeted strikes near Gulf waters. | Saw heightened price volatility across global benchmarks. | ||||||

| 2021 | The diplomatic blockade imposed on Qatar led to logistical bottlenecks affecting exports. | Caus ed interruptions along key gas export routes impacting delivery schedules. td> tr > < /tbody > < /table > The Broader Consequences for International Energy Markets Amid Rising UnrestThe persistent unrest throughout parts of the Middle East underscores how deeply intertwined geopolitical stability is with worldwide fuel availability and pricing structures . As conflicts threaten vital production hubs or transit pathways , market watchers are revising forecasts , anticipating possible surges due to constrained supplies . Factors shaping these outlooks encompass : p >

|