South Africa’s Monetary Policy Enters a New Phase with Interest Rates in Neutral Territory

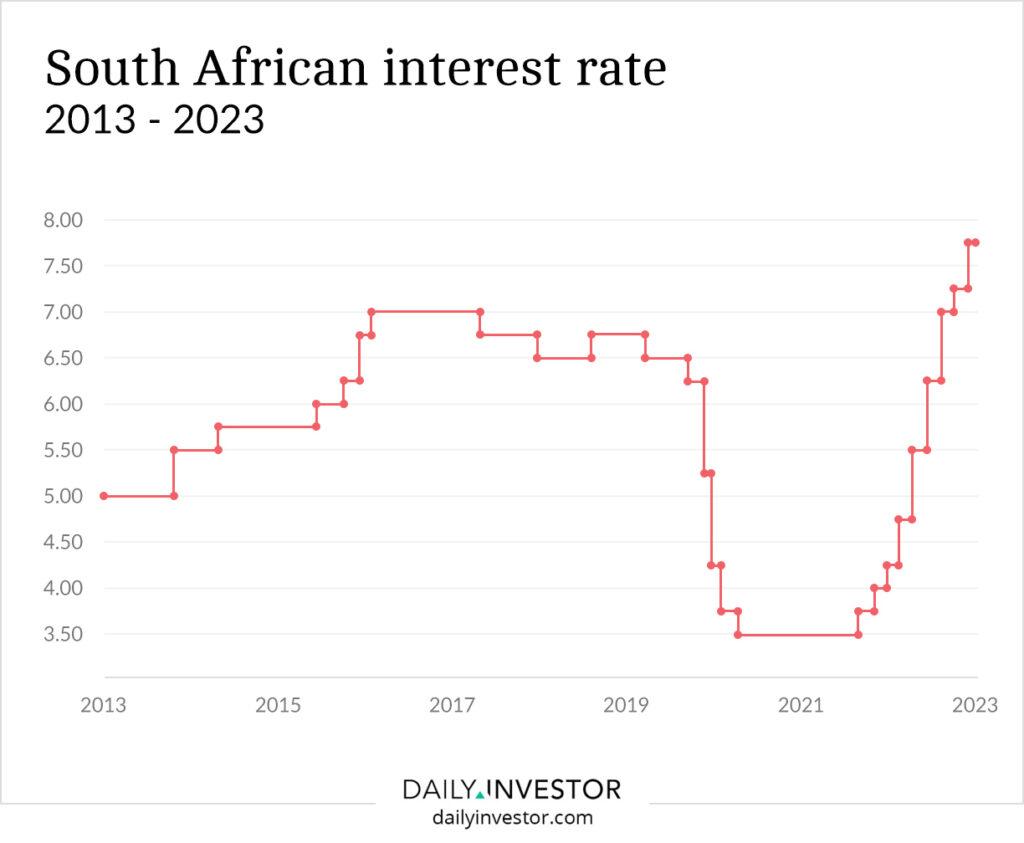

In a notable move impacting South Africa’s economic framework, the South African Reserve Bank (SARB) has recently adjusted its interest rates, signaling a strategic transition in monetary policy. The deputy governor of SARB emphasized that current interest rates now reside within what is termed a “neutral zone,” marking an equilibrium point designed to balance inflation control and economic expansion. This recalibration comes amid persistent inflationary pressures and global economic uncertainties, aiming to invigorate growth while maintaining financial stability.

Understanding the Central Bank’s Shift: Balancing Growth and Inflation

The latest rate reduction by SARB reflects an intentional effort to foster an environment conducive to sustainable development without exacerbating inflation risks. By positioning interest rates neutrally, the central bank seeks to encourage borrowing and investment while preventing overheating of the economy. This approach acknowledges both international market volatility and domestic challenges such as fluctuating consumer demand and sector-specific constraints.

- Promoting Economic Stability: The neutral stance aims at creating steady conditions for long-term growth rather than short-term stimulus or contraction.

- Inflation Moderation: Maintaining inflation within target thresholds remains paramount, avoiding excessive cost burdens on households and enterprises.

- Sustaining Vital Industries: Focused support is directed toward sectors like housing development and retail trade that have faced headwinds from prior restrictive policies.

This policy adjustment draws upon recent data trends including consumer expenditure patterns, business confidence indices, and GDP projections. Analysts anticipate that this balanced approach will influence spending habits as well as capital allocation decisions across various industries in South Africa.

| Date | Interest Rate (%) | GDP Growth Rate (%) |

|---|---|---|

| July 2023 | 6.75 | 2.1 |

| October 2023 | 6.25 | 2.5 |

| March 2024* | 6.00 | -0.3* |

The Dual Impact: How Interest Rate Changes Affect Growth Dynamics & Inflation Trends

The decision to lower interest rates into this neutral range serves multiple purposes: stimulating borrowing activity among consumers and businesses while carefully monitoring inflationary consequences that could arise from easier credit conditions.

A key challenge lies in managing rising prices alongside efforts to boost economic momentum—an intricate balancing act for policymakers given recent global disruptions such as supply chain bottlenecks and energy price fluctuations affecting South Africa’s import costs.

| Year | Average Interest Rate (%) | Inflation Rate (%) | Consumer Price Index (CPI) Trend (%) * |

|---|---|---|---|

| 2 .75 | 5 .2 | +1 .4 | |

This table highlights how reductions in benchmark lending rates have coincided with incremental rises in inflation metrics over recent years—a pattern requiring vigilant oversight by SARB officials moving forward.

The central bank continues tracking core indicators such as producer price indexes (PPI), wage growth statistics, alongside headline CPI figures to calibrate future interventions effectively.

Economic forecasts suggest cautious optimism but underscore potential vulnerabilities if external shocks intensify or domestic demand surges unexpectedly.

*Note: March data are provisional estimates reflecting early Q1 trends.*

Navigating Financial Decisions Amidst Changing Monetary Conditions: Advice for Investors & Consumers

The current monetary landscape presents both opportunities and risks for market participants.

Investors should consider diversifying holdings across asset classes resilient during stable-rate periods—such as dividend-paying equities in utilities or consumer staples—and explore fixed-income instruments offering predictable yields amid moderate rate environments.

- Diversification into government bonds or corporate debt can provide portfolio stability against equity volatility;

- The real estate sector may benefit from increased affordability due to lower mortgage costs; however, investors must assess local market fundamentals carefully;

- Keen attention should be paid to evolving inflation expectations which directly impact asset valuations over time;

Consumers stand poised potentially benefiting from reduced financing expenses but must exercise prudence:

- Earmarking funds towards refinancing existing loans can reduce monthly obligations;

- Cautious budgeting focused on essential expenditures helps mitigate exposure during uncertain times;

- An emphasis on building emergency savings cushions households against unforeseen financial shocks amidst ongoing global instability;

A Forward-Looking Perspective on South Africa’s Economic Outlook

SARB’s repositioning of interest rates into a neutral zone signals measured confidence yet underscores ongoing vigilance required amid complex macroeconomic forces.

This calibrated stance offers flexibility allowing adjustments responsive either toward tightening if inflation escalates or easing should growth falter further.

Market watchers will closely monitor upcoming quarterly GDP releases along with employment figures which remain critical barometers of underlying health.

Ultimately, this phase sets the stage for potentially steadier investment climates fostering renewed business confidence while safeguarding purchasing power across diverse socioeconomic groups throughout South Africa.

*All statistical references reflect most recent publicly available data up through mid-2024.*