Indian Rupee Strengthens Amid Growing Expectations of U.S. Federal Reserve Rate Cuts

Throughout a week marked by volatile global economic signals, the Indian rupee has showcased notable strength, largely driven by rising anticipation of interest rate reductions from the U.S. Federal Reserve. Market participants and analysts are vigilantly tracking shifts in American monetary policy, recognizing its critical influence on currency valuations worldwide. As the rupee continues to build momentum, the dynamic between expected Fed easing and India’s domestic economic environment becomes increasingly significant. This evolving scenario highlights potential boosts in investor confidence and sheds light on future prospects for India’s economic framework. This article delves into the key drivers behind the rupee’s recent rally and examines broader consequences tied to anticipated changes in U.S. monetary policy.

How Fed Rate Cut Expectations Are Fueling the Rupee’s Upward Momentum

The surge in speculation about possible interest rate cuts by the Federal Reserve has been a major catalyst propelling the Indian rupee higher over recent days. Investors are increasingly optimistic that a more accommodative stance from Washington could create favorable conditions for emerging market currencies like INR. Experts observe that this dovish outlook is encouraging capital inflows into India, thereby strengthening its currency against the dollar.

This trend aligns with a wider appetite for riskier assets as signs emerge pointing toward an economic slowdown in the United States.

- Diminishing Dollar Strength: The dollar has softened amid growing expectations of looser monetary policy.

- Surge in Foreign Investments: Enhanced foreign direct investment (FDI) flows reflect investors’ search for higher yields outside traditional safe havens.

- Positive Economic Indicators: Stronger-than-expected domestic data combined with external factors have bolstered market sentiment towards India.

| Date | Rupee Exchange Rate (per USD) | % Change |

|---|---|---|

| Monday | 74.85 | -0.10% |

| Tuesday | 74.60 | +0.33% |

| Wednesday | 74.30 | +0.40% |

| Thursday74.00 | ||

| Date | Rupee Exchange Rate (per USD) | % Change < / tr > < /thead > | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | Rupee Exchange Rate (per USD) | % Change | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Monday74..85-0.10The Role of Monetary Policy Adjustments in Currency Market Dynamics

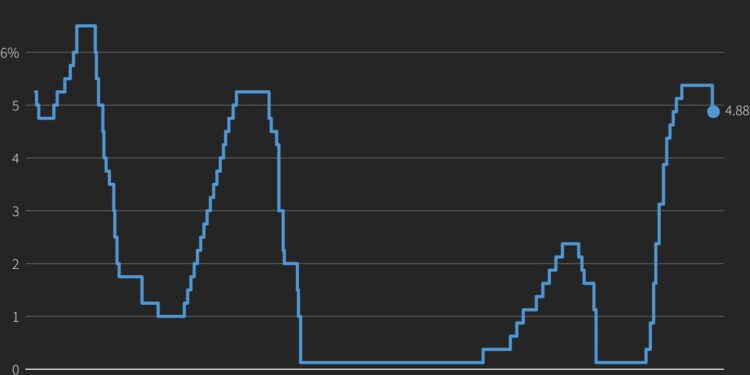

The evolving landscape of central bank policies—especially with regard to anticipated interest rate reductions by major players like the Federal Reserve—has had profound effects on global currency markets recently. A decrease in benchmark rates typically exerts downward pressure on a nation’s currency value due to diminished returns attracting less foreign capital initially; however, when viewed within broader macroeconomic contexts marked by uncertainty or slowing growth—as currently observed—the stimulus effect can enhance certain currencies’ appeal relative to others such as INR versus USD. Economic experts forecast that if these expectations materialize into actual Fed easing measures, it could sustain or even accelerate gains made by emerging market currencies including India’s rupee through several mechanisms:

The following table compares recent weekly performance across select currencies reflecting these trends:

|