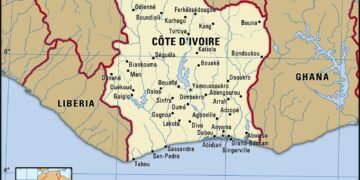

In a move aimed at revitalizing its struggling economy, the Ivory coast has turned to the World bank for assistance in restructuring its debt obligations. As the West African nation grapples with the financial burdens of high-interest loans and a slowing growth rate, the goverment seeks to alleviate its fiscal pressures and foster enduring economic growth. By engaging with the World Bank, officials hope to secure more favorable terms that will not only reduce the costs of servicing existing debt but also unlock additional funds for critical infrastructure projects and social programs. This strategic pivot reflects a growing trend among countries facing similar challenges, highlighting the pivotal role international financial institutions play in stabilizing economies amid a global financial landscape marked by uncertainty.

Ivory Coast Faces Debt Challenges Amid Economic Pressures

the economic landscape in Ivory Coast is undergoing significant transformations as the country grapples with escalating debt challenges. With a mounting fiscal burden and pressures from fluctuating commodity prices, the government has found itself in dire need of restructuring its financial obligations.As the national debt continues to soar, officials are seeking innovative solutions, especially through partnerships with global financial institutions. Key factors contributing to this financial strain include:

- Declining cocoa and coffee prices, which are vital to the nation’s economy

- Rising inflation further squeezing consumer spending and investment

- Increased external debt payments that divert resources from essential services

In response to these economic pressures, Ivory Coast has approached the World Bank for assistance in replacing its more expensive debt obligations with more sustainable financing options. this partnership is not only aimed at refinancing current debts but also at implementing long-term strategies to bolster economic stability and growth. Potential benefits of this collaboration may encompass:

- Access to lower interest rates which can ease fiscal burden

- Technical expertise in economic management

- Opportunities for infrastructure development and job creation

World Bank’s Role in Restructuring Ivory Coast’s Debt

the World Bank is stepping in as a crucial partner for Ivory Coast,offering viable solutions to the nation’s burgeoning debt crisis. Facing the burden of high-interest loans and a challenging economic landscape, the government is looking to shift from expensive debt structures to more sustainable options. By engaging with the World Bank, Ivory Coast aims to restructure its obligations while reducing overall financial strain.This collaboration is seen as vital not only for immediate relief but also for fostering long-term economic stability.

Key initiatives proposed include:

- Debt Forgiveness: Assessing opportunities for forgiving portions of the existing debt to free up fiscal space.

- Re-lending Programs: Introducing lower interest loans with extended repayment terms to replace older debt.

- Capacity Building: Enhancing government capabilities to manage public finances effectively.

Furthermore, the collaboration involves targeted investment in infrastructure projects, which not only aim to stimulate economic growth but also enhance revenue generation. By creating a more stable fiscal environment, Ivory Coast hopes to attract foreign investments and secure a path toward a more resilient economy.

Impact of Costly Debt on Ivory Coast’s Development Goals

The burden of costly debt looms large over Ivory Coast’s aspirations for sustainable growth and development. With a significant portion of the national budget allocated to servicing loans, the government faces increasing difficulties in financing essential sectors such as education, healthcare, and infrastructure. This financial strain diverts resources away from long-term development projects, hampering the country’s progress towards achieving its national development goals. moreover, high-interest rates on existing debts further exacerbate the situation, pushing the nation into a recurring cycle of borrowing that threatens economic stability and resilience.

In response to these challenges, the Ivory Coast is seeking assistance from international financial institutions like the World bank. This strategic pivot aims to replace high-cost debt with more favorable lending terms that can better support the country’s development initiatives. By securing lower-interest loans and aligning their financing with national priorities, the government hopes to reinvest savings into crucial areas, such as:

- Infrastructure development

- Education and workforce training

- Healthcare improvements

- Agricultural modernization

This approach not only rejuvenates the economy but also fosters a sustainable trajectory toward enduring growth, ultimately empowering the Ivorian population while promoting social equitability.

Strategic Recommendations for Sustainable Debt Management

To navigate the complexities of debt management, particularly in the context of Ivory Coast’s significant shift towards world Bank assistance, several strategic recommendations emerge that could enhance fiscal sustainability. firstly, ther is a critical need for comprehensive debt audits to assess current liabilities accurately. This process will provide insightful data to guide policymakers in prioritizing financial obligations and identifying opportunities for debt restructuring. Additionally, strengthening public financial management systems is essential. By enhancing clarity and efficiency in budgeting processes, ivory Coast can foster greater investor confidence and facilitate better terms in any future borrowing.

Moreover, diversifying funding sources is an effective strategy that Ivory Coast should consider. By engaging with various international development partners and exploring public-private partnerships, the country can lower its dependence on conventional financial institutions and reduce costlier debts. Othre recommendations include:

- Implementing robust economic reforms to stimulate growth and increase revenue generation.

- Establishing an independent debt management office to monitor and advise on sustainable borrowing levels.

- Embedding sustainability criteria into all future loan agreements,ensuring that funds are utilized in projects that support long-term development.

Examining the Long-Term Benefits of World Bank Support

The partnership between Ivory Coast and the World Bank is more than a financial agreement; it represents a strategic investment in the nation’s sustainable development.By leveraging world Bank support, Ivory Coast can pivot towards innovative economic policies that prioritize growth while reducing reliance on costly debt instruments. Key benefits of this collaboration include:

- Improved Infrastructure: The World Bank’s funding can enhance transportation, energy, and social infrastructure projects, creating a robust foundation for economic expansion.

- Job Creation: Investments in various sectors foster employment opportunities, significantly impacting the lives of ordinary citizens.

- Capacity Building: Technical assistance and training provided by the World Bank equip local institutions with the necessary skills and knowledge for effective governance and resource management.

Moreover, the focus on sustainable practices ensures that economic growth does not compromise environmental integrity. With a framework for accountability and clear usage of funds, the partnership promotes long-term economic resilience. A comparative analysis of fiscal outcomes following similar collaborations can provide deeper insights into potential trajectories for Ivory Coast. Below is a table illustrating key metrics from other nations’ engagements with the World Bank:

| Country | Project Type | Growth Rate Increase (%) | Job Growth (%) |

|---|---|---|---|

| Ghana | Infrastructure Development | 4.5 | 15 |

| Ethiopia | Agriculture and Rural Development | 5.2 | 12 |

| Nigeria | Education and Health | 3.8 | 10 |

In Retrospect

Ivory Coast’s strategic decision to engage with the World Bank underscores the nation’s urgent need to alleviate the burden of expensive debt while fostering a more sustainable financial framework. As the government seeks to stabilize its economy amid rising global interest rates and domestic fiscal pressures, this partnership could pave the way for more favorable financing conditions and enhanced economic resilience. The unfolding developments will be closely watched by international investors and stakeholders, as Ivory Coast aims not only to mitigate current challenges but also to secure a more prosperous future for its citizens. Moving forward, the effectiveness of this collaboration will be crucial in determining the nation’s path towards fiscal stability and growth.