Iron Ore Market Dynamics: Navigating Price Volatility Amid Trade Tensions

Recent Trends in Iron Ore Prices and Market Recovery Signals

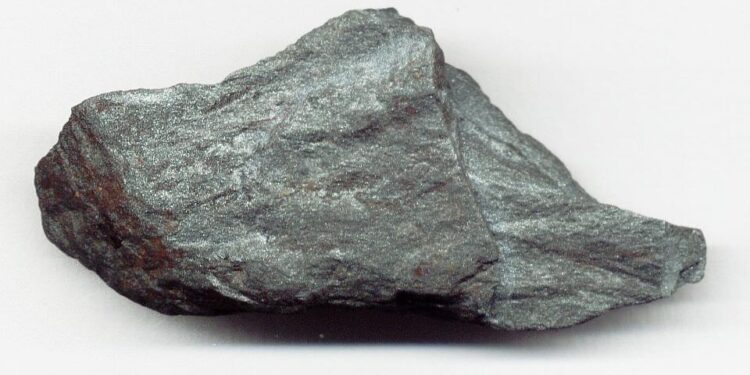

In the ever-shifting arena of global commodity trading, iron ore prices have recently shown a modest rebound following a turbulent week marked by steep declines. Despite this slight recovery, persistent concerns over tariffs and international trade disputes continue to cast uncertainty over the market’s trajectory. The interplay between evolving trade policies and supply chain disruptions has created a challenging environment for investors and producers alike.

Emerging data points to a tentative stabilization in prices, largely fueled by renewed demand from infrastructure development projects across key economies. This uptick is supported by several critical factors:

- Boosted output from leading mining companies: Producers are increasing extraction rates to satisfy growing consumption needs, especially from China’s steel sector.

- Revitalization of steel production: A resurgence in steel manufacturing is driving higher iron ore usage globally.

- Positive economic indicators worldwide: Upward revisions in GDP forecasts across multiple regions contribute to improved market sentiment.

Nevertheless, tariff-related apprehensions remain a significant headwind. Potential adjustments or expansions of import duties threaten to destabilize this fragile recovery phase. Key geopolitical developments under scrutiny include:

| Main Factor | Market Implication |

|---|---|

| Tensions Between U.S. and China | Ironic price swings driven by tariff impositions could reshape bilateral trade flows. |

| Evolving EU Tariff Regulations | The introduction of new levies may alter import volumes and pricing structures within Europe. |

| Sustained Global Supply Chain Challenges | Difficulties in logistics may increase operational costs and cause intermittent shortages. |

This Week’s Price Fluctuations: Underlying Causes & Future Projections

The past week witnessed pronounced volatility in iron ore valuations as traders reacted to ongoing uncertainties surrounding tariffs alongside shifting demand patterns among major consumers. Two dominant influences shaped these movements:

- The impact of tariff negotiations: Discussions about export duties on iron ore shipments—particularly those originating from Australia and Brazil—have injected unpredictability into pricing mechanisms while affecting international partnerships.

- Divergent Chinese consumption trends: China’s mixed signals regarding economic recovery have led to fluctuating steel output levels; recent government stimulus measures aimed at boosting urban construction are expected to gradually elevate raw material demand through late 2024.

According to the latest reports from the National Bureau of Statistics (NBS), China’s crude steel production rose by approximately 3% year-over-year for Q1-Q2 2024, signaling cautious optimism amid broader economic challenges. - Supply chain responsiveness: Adjustments made by top-tier miners reacting prudently to softened demand forecasts could help stabilize prices if coordinated effectively.

- Macroeconomic variables: Inflationary pressures, currency exchange rate shifts, as well as geopolitical tensions will continue influencing market fundamentals significantly.

- Strategic moves like Vale’s acquisition consolidations also play an important role shaping supply dynamics globally.

- ● Keen Monitoring: Diligently track news sources covering international trade developments relevant to mineral exports/imports.

- ● Liaising With Industry Experts: Tapping into specialized analyses forecasting potential corrections or trend reversals can provide valuable foresight.

- ● An Assessment Of Supply Chain Health: Evolving logistical constraints should be factored into risk evaluations given their direct effect on inventory levels.& nbsp;

- ● Mitigative Financial Instruments:& nbsp; Hedging via futures contracts or options can shield portfolios against adverse price movements during periods marked by heightened uncertainty.& nbsp;

Final Thoughts on Iron Ore Price Movements Amid Trade Challenges and Economic Shifts

This week’s minor rebound in iron ore prices belies an underlying fragility rooted primarily in unresolved tariff issues that continue exerting downward pressure overall — culminating ultimately in net weekly losses despite short-lived gains.

As global consumption patterns remain uneven amid mounting geopolitical strains,

market participants must maintain vigilance toward evolving policy landscapes.

Careful observation of ongoing negotiations coupled with adaptive investment strategies will be essential tools enabling stakeholders—from miners through financiers—to weather forthcoming uncertainties.

The resilience demonstrated thus far suggests potential stability ahead if external shocks subside,

yet volatility remains an inherent feature demanding continuous attention moving forward throughout late 2024.

SEO Keywords Retained: iron ore prices, tariffs impact on iron ore, Chinese demand for iron ore, global supply chain disruptions, mining sector challenges, investment strategies for commodities markets.

. . .

The outlook remains cautiously optimistic but heavily contingent on how global trade policies evolve alongside supply-side responses. Analysts emphasize two pivotal areas shaping near-term prospects:

| Influencing Factor | Effect on Market Pricing & Stability |

|---|---|

| Tariff Policies | Elevate costs while limiting access across markets |