The Kano State government has recently taken decisive action by sealing off the operations of Max Air, a prominent Nigerian airline, amid allegations of tax evasion. This move highlights ongoing concerns regarding compliance with fiscal regulations within the aviation industry and underscores the state’s commitment to enforcing tax laws. The decision has sparked discussions about the implications for the airline sector and the broader economy, raising questions about regulatory practices and corporate accountability in Nigeria. As stakeholders navigate the complexities of governance and taxation,the case of Max Air serves as a crucial point of reference in understanding the interplay between business operations and state oversight in the region.

Kano Government Takes action Against max Air for Alleged Tax Evasion

The Kano state government has taken a decisive stance against max Air, a significant player in nigeria’s aviation sector, by sealing its operations due to allegations of tax evasion.Authorities conducted a thorough inquiry which indicated that the airline had failed to remit substantial sums owed to the state, raising concerns over fiscal compliance in a sector already facing rigorous scrutiny. This move underscores the government’s commitment to ensuring that all businesses operate within the legal tax framework, thereby contributing to the state’s revenue generation and economic stability.

Industry experts suggest that this action might have broader implications for the aviation market, as it signals a strict enforcement of tax regulations. Many operators may now reconsider their financial practices to avoid similar repercussions. Moreover, the Kano government’s stance raises questions about the accountability of corporations in meeting their fiscal responsibilities. The situation has prompted discussions among stakeholders regarding lasting business practices and the role of government oversight in fostering a fair economic environment. It remains to be seen how Max Air will respond to these allegations and whether it can rectify its standing with state authorities.

Implications of Tax Compliance for airlines in Nigeria’s Business Environment

The recent closure of Max Air by the Kano state government due to allegations of tax evasion raises significant concerns about the broader implications of tax compliance for airlines operating in Nigeria. Striking a balance between adhering to tax regulations and maintaining operational efficiency is vital for airlines to thrive in a competitive market. Airlines must recognize that tax compliance is not merely an obligation but a critical component of their business strategy. Failure to comply can lead to severe repercussions, including financial losses, reputational damage, and operational disruptions.

Moreover, ensuring tax compliance can potentially enhance a company’s standing in the eyes of both authorities and customers. Some potential benefits include:

- Improved Reputation: companies that comply with tax regulations are perceived as responsible and trustworthy.

- Operational Continuity: Maintaining compliance reduces the risk of government interventions that could halt operations.

- Access to Benefits: compliant companies may gain access to government incentives and partnerships.

table of Compliance Strategies for Airlines:

| strategy | Description |

|---|---|

| Regular Audits | Conduct audits to ensure financial integrity and compliance. |

| Employee Training | Educate staff on tax laws and compliance requirements. |

| Consultation | Engage tax consultants for expert guidance and strategies. |

The Role of Regulatory Bodies in Managing Tax Issues in the Aviation Sector

The aviation sector is subject to a myriad of regulations aimed at ensuring compliance with tax obligations. Regulatory bodies play a crucial role in this landscape by enforcing tax laws that govern aviation operations. Their responsibilities include monitoring financial activities, conducting audits, and imposing penalties for non-compliance. In Nigeria, incidents like the recent sealing of Max Air highlight the necessity for stringent oversight and accountability in the industry. These bodies aim to create a level playing field for all airlines, ensuring that no entity gains an unfair advantage through tax evasion.

Moreover, the regulatory framework established by these bodies helps foster a culture of transparency within the aviation sector. They not only combat tax evasion but also provide guidance to airlines on meeting their tax obligations. This proactive engagement encourages companies to adopt better financial practices, thereby contributing to the overall growth and sustainability of the aviation industry.The consequences of inadequate regulatory oversight can be significant, leading to lost revenue for governments and an uneven competitive landscape. so, regulatory bodies serve as the backbone of fiscal discipline in the aviation sector, safeguarding the interests of both the state and responsible businesses.

Recommendations for Max Air to Address Tax Compliance challenges

To effectively navigate and mitigate tax compliance challenges, Max air shoudl implement a thorough strategy that focuses on improving transparency and accountability in its financial practices. Conducting regular internal audits can aid in identifying potential discrepancies and ensuring adherence to tax regulations.Additionally, establishing a clear dialog channel with tax authorities will help in resolving any disputes proactively. Leveraging technology by investing in robust accounting software can streamline tax reporting processes, minimizing the risk of errors that could lead to penalties.

Furthermore, it is essential for Max Air to foster a culture of compliance within the organization. This can be achieved through training sessions for staff on tax obligations and implications. creating a dedicated compliance team to oversee tax matters can also prove beneficial in maintaining ongoing awareness of legislative changes. By implementing the following practices, Max Air will not only enhance its tax compliance but also build a positive reputation within the business community:

| Recommendations | Benefits |

|---|---|

| Regular Internal Audits | identify discrepancies early |

| Establish Communication with Tax Authorities | Proactive dispute resolution |

| Invest in Accounting Software | Streamlined tax processes |

| Staff Training on Tax Obligations | Enhanced compliance culture |

| Dedicated Compliance Team | Ongoing awareness of changes |

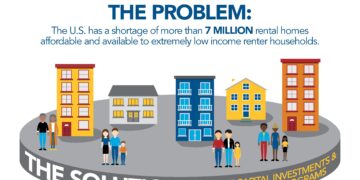

Wider Economic Impact of Tax Evasion on Nigeria’s Aviation Industry

Tax evasion poses a significant threat to the stability and growth of Nigeria’s aviation industry, affecting not only corporate integrity but also broader economic conditions. When airlines like Max Air allegedly evade taxes, the ripple effects can be felt throughout the economy. Reduced tax revenues limit governmental investments in critical infrastructure, including aviation facilities, transportation corridors, and security measures. consequently, this leads to a decrease in the competitive edge of Nigerian airlines against their international counterparts, who operate in a landscape where tax compliance is strictly monitored. Moreover, the lack of infrastructure investments due to diminished public funds can deter potential foreign investments in the aviation sector, stifling growth and innovation.

Furthermore, tax evasion undermines the level playing field within the aviation sector, as compliant carriers face challenges against those that do not operate within legal financial frameworks. This leads to unfair competition, where honest businesses struggle to survive while dealing with the repercussions of an unregulated market. As the sector grapples with issues like diminished public trust and lowered investor confidence, the overall economic impact can extend into job losses, reduced service quality, and increased operational costs. In turn, this hampers the country’s gross domestic product (GDP) growth, as a vital industry like aviation plays a critical role in trade, tourism, and connectivity, impacting the lives of everyday Nigerians.

Future Prospects for Nigeria’s Airline Sector Amid Regulatory Scrutiny

The recent actions taken by the Kano state government against Max Air highlight the increasing regulatory scrutiny faced by nigeria’s airline sector. This move comes amidst ongoing concerns regarding compliance with tax obligations, raising questions about the long-term sustainability of airline operations in a region often viewed as fraught with bureaucratic challenges. As regulatory bodies tighten their grip, operators may need to reassess their business strategies to align with legal requirements, ultimately fostering a more robust framework for air travel in Nigeria.

Looking ahead, there are several key elements that could shape the future landscape of Nigeria’s aviation industry:

- Enhanced Compliance Measures: Airlines may need to invest in compliance systems to manage regulatory requirements effectively.

- Investment Opportunities: Increased scrutiny could attract foreign investors keen to operate in a more structured environment.

- Consumer Confidence: Improved regulatory oversight might restore public trust in air travel safety and reliability.

Furthermore, the sector’s growth may also depend on collaborative efforts between the government and industry stakeholders to create a obvious regulatory framework. In this dynamic environment, integrating advanced technology and financial literacy into airline operations will be crucial for navigating the regulatory landscape.

to sum up

the sealing of max air by the Kano government serves as a significant advancement in the ongoing discourse surrounding corporate compliance and tax responsibilities in Nigeria. As authorities escalate their efforts to ensure that businesses adhere to tax regulations, this move underscores the broader implications for the aviation sector and its stakeholders. The outcome of this situation may not only impact Max Air’s operations but also prompt a reevaluation of tax practices among other airlines operating in the region.as the story unfolds, it will be crucial to monitor both the legal proceedings and the responses from affected entities, as they will ultimately shape the future landscape of Nigeria’s aviation industry and fiscal integrity. Continued scrutiny will remain essential as the balance between regulatory enforcement and support for businesses is navigated in this complex economic environment.

How Trump’s Tariffs Transformed a Mexican Businessman into a Grateful Ally