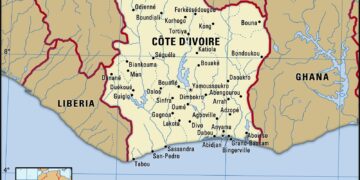

In a bold move aimed at enhancing economic stability and fostering regional integration, Ivory Coast’s president, Alassane Ouattara, has announced plans to establish a common currency for West Africa by 2026. This ambitious initiative seeks to unite the diverse economies of the Economic Community of West African States (ECOWAS) under a single monetary system, potentially transforming trade dynamics and monetary policy across the region. As discussions intensify among member states, the proposal has sparked a mix of anticipation and skepticism, drawing attention to the challenges and opportunities that lie ahead. This article explores the implications of President Ouattara’s vision for a unified currency, the response from neighboring countries, and the broader impact on West Africa’s economic landscape.

Ivory Coast’s Economic Vision: A Regional Currency by 2026

The push for a shared currency among West African nations has gained momentum,driven by Ivory Coast’s President. Advocates believe that a common regional currency could significantly enhance trade, reduce transaction costs, and stabilize economies within the region. By creating a unified monetary system, member states could experience benefits that include:

- Increased Economic Integration: A shared currency would facilitate easier cross-border trade.

- Mitigation of Currency Volatility: Countries may face fewer fluctuations in currency values.

- Enhanced Investment Opportunities: A stable currency could attract foreign investment.

Despite the promising outlook, the journey toward implementing a regional currency is fraught with challenges. Concerns about economic disparities among member states, governance structures for currency management, and potential resistance from existing financial institutions must be addressed. To assist in visualizing the economic landscape and the anticipated impacts of a shared currency, consider the following table showing key economic indicators of potential member countries:

| Country | GDP (2023 Estimate) | Population (Millions) | Current Currency |

|---|---|---|---|

| Ivory Coast | $64 Billion | 26 | West African CFA Franc |

| Ghana | $74 Billion | 32 | Ghanaian Cedi |

| Nigeria | $450 Billion | 223 | Nigerian Naira |

| Senegal | $28 Billion | 17 | West African CFA Franc |

Implications for Trade and Investment in West Africa

The push for a common regional currency in West Africa, led by Ivory Coast’s President, holds meaningful implications for trade and investment across the region. By fostering a unified currency system, the Economic Community of West African States (ECOWAS) aims to enhance trade efficiency, reduce transaction costs, and mitigate the risks associated with currency fluctuations. A common currency could simplify cross-border trade, encouraging businesses to engage more freely without the burden of multiple currencies and exchange rates. This streamlined process is projected to bolster intra-regional trade, which remains underdeveloped despite the wealth of resources present in member countries.

Investment flows are also set to experience transformative changes in light of this monetary integration. With a stable and widely accepted currency, investors will have more confidence in investing in West African markets, which may attract foreign direct investment (FDI) that has historically been deterred by economic instability and currency risks. The anticipated economic growth could further lead to the growth of key sectors including agriculture, technology, and manufacturing. To illustrate the potential benefits, consider the following table:

| Potential Benefits | Impact |

|---|---|

| Increased Trade Volume | Expected rise in intra-regional trade by 20% within the first five years. |

| Reduced Cost of Transactions | Elimination of multiple currency exchanges could lower costs by up to 15%. |

| Enhanced Investor Confidence | Projected uptick in FDI due to improved market predictability. |

Challenges Ahead: Political and Economic Hurdles to a Common Currency

The push for a common currency in the West African region presents a myriad of challenges, both political and economic. political resistance among member states remains a significant hurdle,as national leaders are frequently enough hesitant to cede monetary authority to a central body. Factors contributing to this skepticism include:

- concerns over loss of national sovereignty

- Disparities in economic performance and fiscal discipline among member countries

- Varying levels of political stability and governance quality

Economically, the implementation of a common currency requires comprehensive coordination and a shared vision among the member nations. Challenges faced include the necessity for harmonized fiscal policies, robust economic governance frameworks, and shared monetary policies.Additionally, the region must address various disparities, such as:

- Differences in inflation rates

- national existing debts and deficits

- Varying levels of development and infrastructure

To effectively navigate these challenges, collaboration and commitment from all parties involved will be crucial, along with a clear roadmap outlining stages of integration.

Expert Insights: What economists Are Saying About the Proposal

Economists are weighing in on the ambitious proposal led by Ivory Coast’s President to establish a common regional currency by 2026. Many experts argue that a unified currency could foster economic stability and facilitate trade among West African nations.They point out that by reducing transaction costs,countries would likely experience increased investment and consumer confidence. Potential benefits include:

- Streamlined cross-border trade

- Reduced vulnerability to currency fluctuations

- Enhanced economic integration within the region

However, some economists express concerns about the feasibility of such a project. The challenges of aligning monetary policies among diverse economies could hinder the effectiveness of a common currency. Furthermore, there are apprehensions regarding the political will necessary for member countries to relinquish some degree of monetary sovereignty. Experts highlight that careful planning and collaboration are essential. Key issues to address include:

- Establishing a central bank with authority and credibility

- Ensuring fiscal discipline across member states

- Navigating political resistance from national governments

Recommendations for Stakeholder Engagement and Collaboration

To facilitate the establishment of a common regional currency in Ivory Coast by 2026, effective stakeholder engagement is crucial. It is essential to identify key players in the financial, political, and economic sectors who will contribute to a collaborative dialog. This collaboration should include:

- Government Authorities: Involving national and regional government representatives will ensure that policy frameworks align with local needs.

- Central banks: Engaging with central banks is vital to address monetary policy and regulatory concerns related to the currency transition.

- Private Sector Leaders: Input from businesses will help shape a currency that meets commercial requirements and fosters economic growth.

- Civil Society Organizations: Incorporating perspectives from grassroots organizations can enhance public support and address community concerns.

Beyond identifying stakeholders, establishing structured interaction and feedback mechanisms will be necessary for long-term success. A collaborative approach can be fostered through:

- Regular Workshops and Forums: Hosting events can facilitate discussions about shared interests and common goals.

- Public Awareness Campaigns: Educating citizens about the benefits and implications of a common currency will help garner support from the broader community.

- Digital Platforms: Creating online spaces for stakeholder discussions can enhance openness and keep all parties informed.

The Future of Monetary Policy in West Africa: A Unified Approach

In a bold move signaling a commitment to regional unity,Ivory Coast’s President has set an ambitious goal for a common currency by 2026. This initiative reflects a growing consensus among West African nations about the necessity of integrating their economies to enhance stability and foster growth.The proposed currency, which aims to replace the current CFA franc, is expected to facilitate trade within the Economic Community of West African States (ECOWAS) and strengthen monetary cooperation. The rationale behind this shared currency includes:

- Reduction of Transaction Costs: A unified currency can significantly lower the costs of cross-border trade.

- Increased Economic Resilience: A common currency can buffer countries against external shocks.

- Enhanced regional Investment: Investors are more likely to engage in markets where currency risks are mitigated.

though, the transition to a unified currency is fraught with challenges. Countries within the region must align their fiscal policies and ensure that economic fundamentals are robust enough to support a shared currency.This entails a commitment to maintaining stable inflation rates, sound public finances, and cooperative monetary frameworks. A recent table summarizing the current economic indicators of ECOWAS member states can provide insight into the readiness for such a significant change:

| Country | GDP growth (%) | Inflation Rate (%) | Public Debt (% of GDP) |

|---|---|---|---|

| Ivory Coast | 7.0 | 2.3 | 52.4 |

| nigeria | 3.2 | 15.6 | 36.2 |

| Ghana | 5.2 | 8.9 | 76.1 |

As the dialogue progresses, the emphasis remains on ensuring that all participating nations can benefit equitably from the proposed monetary union. This is not merely a financial shift,but a pivotal step towards enhancing regional cooperation,fostering economic growth,and securing a more prosperous future for West Africa.

To wrap It Up

President Alassane Ouattara’s push for a common regional currency by 2026 represents a significant step toward economic integration in West Africa. With the potential to enhance trade efficiency, stabilize currencies, and strengthen regional partnerships, the initiative could reshape the economic landscape of the region. though, as discussions progress, stakeholders will need to address various challenges, including political stability, economic disparities, and the regulatory frameworks necessary for such a transformative endeavor. As Ivory Coast and its neighboring nations move forward, the global community will be closely watching the developments of this ambitious project, which could set a precedent for regional cooperation and economic collaboration in Africa.