China Accelerates Tech Growth Through Innovation Bond Financing

In a strategic effort to propel its rapidly expanding technology sector, an increasing number of Chinese enterprises are turning to the financial markets by issuing innovation bonds. These specialized debt securities are crafted to fund research and development projects, reflecting companies’ eagerness to align with Beijing’s vigorous agenda for technological progress. As China intensifies reforms and channels investments into pivotal industries such as AI, biotechnology, and renewable energy, this financing approach marks a significant evolution in how innovation is capitalized within the country.

The surge in innovation bond issuance highlights a broader shift toward fostering self-reliance amid global trade frictions and competitive pressures. By tapping into these bonds, firms not only secure essential funding but also demonstrate their commitment to national priorities focused on sustainable technological advancement.

Key Benefits Driving the Rise of Innovation Bonds

The growing popularity of innovation bonds among Chinese companies can be attributed to several compelling advantages:

- Attractive borrowing costs: Issuers benefit from relatively low interest rates compared to traditional financing options.

- Government incentives: Regulatory frameworks actively encourage these issuances through supportive policies and streamlined approval processes.

- Sustainability alignment: Funds raised often target projects with long-term environmental or societal impact, resonating with global ESG trends.

The following data illustrates the rapid expansion in both the number and total value of innovation bond issuances over recent years:

| Year | Total Issuances | Total Amount (Billion Yuan) |

|---|---|---|

| 2021 | 22 | 18 |

| 2022 | 40 | 65 |

| 2023* | 60+ | >90* |

Investment Strategies for China’s Expanding Innovation Bond Market

The burgeoning market for innovation bonds presents lucrative opportunities for investors aiming to participate in China’s tech-driven growth story. With government backing targeting sectors like clean energy technologies, advanced biotech solutions, and artificial intelligence platforms, investors must adopt informed approaches tailored to this dynamic environment.

- Diligent evaluation: Scrutinize issuer credibility by analyzing financial stability alongside their R&D pipeline potential.

- < strong > Portfolio diversification: < / strong > Allocate investments across multiple high-growth sectors within technology ecosystems to balance risk exposure .< / li >

- < strong > Regulatory vigilance: < / strong > Keep abreast of evolving government policies that could affect project viability or market sentiment .< / li >

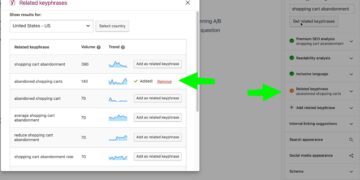

Building partnerships with local financial experts can provide valuable insights into emerging trends. For instance , collaboration between international asset managers and Chinese fintech analysts has recently enhanced predictive accuracy regarding bond performance . Below is a practical framework investors might use when assessing potential bond offerings :

| Opportunity | Risk |

|---|---|

| Access to preferential funding terms & strategic initiatives | Policy volatility could disrupt planning |

Investor Interest | Strong demand enhances capital availability | Speculative behavior may increase price swings |

Long-Term Outlook | Potentially high returns from breakthrough innovations | Market fluctuations threaten issuer sustainability |